Founded by ex-CEO and founder at Printivo, Olu’yomi Ojo, and Yomi Osamiluyi, the Nigerian wealthtech startup, Cova, announced its shutdown.

This decision, outlined in a sincere email to users, was linked to “several factors” prompting the co-founders to halt operations. What precipitated the Cova shutdown, and what insights can we glean from this situation?

Cova’s Mission and Challenges

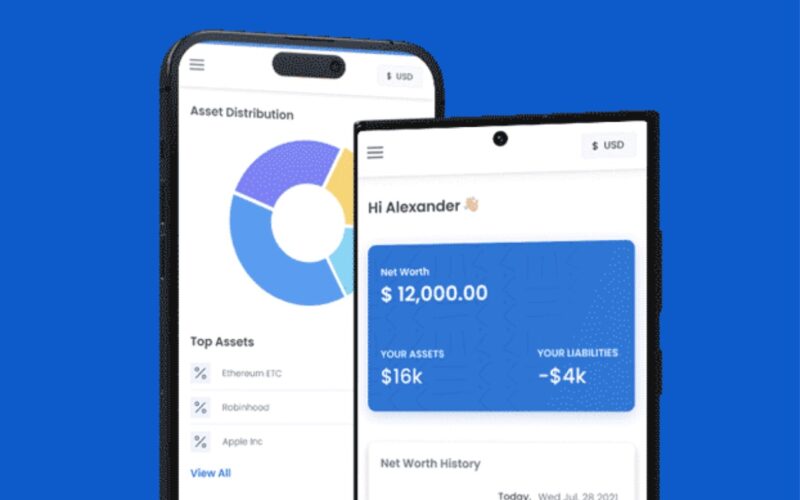

Founded in December 2021, Cova aimed to become a comprehensive asset management platform, simplifying asset management and tracking through connections to various financial services. Despite significant fundraising and diverse subscription offerings, Cova encountered challenges from the outset.

The hurdles were diverse, ranging from the demand for deeper integration for users with assets across different countries to the foundational issue of trust in a new service. Cova’s innovative approach to preparing for the inevitability of death through asset management faced resistance in markets unaccustomed to such planning.

The closure of Cova serves as a poignant reminder of the unpredictable nature of the startup ecosystem, particularly in sensitive and complex sectors like fintech and wealth management. Despite the founders’ best efforts and a unique value proposition, Cova couldn’t overcome barriers to growth and user adoption.

Prioritizing Financial Prudence over Prolongation.

In an email to investors without a specified date, Ojo explained the financial prudence that influenced the challenging decision. Even though there were sufficient funds to sustain operations for another year, the co-founders chose to initiate a shutdown. This decision underscores their dedication to prioritizing the well-being of investors and stakeholders, opting not to deplete resources without a clear path to profitability or substantial revenue.

The Decision to Shutdown

The decision to shut down Cova was not impulsive. According to the co-founders, it was a weighty choice, evident in their communication with users. The announcement, accompanied by a commitment to refund subscriptions, indicated a responsible exit. However, beneath this decision lay underlying issues, pointing to a more intricate situation.

Despite being an innovative force in wealth management, Cova struggled to gain traction. Olumide Soyombo, a prominent Nigerian angel investor and supporter of Cova, disclosed in his business memoir “Vantage” that the startup encountered substantial challenges in garnering user engagement. This difficulty in gaining traction, despite Cova’s unique solution, raised a red flag that could not be overlooked.