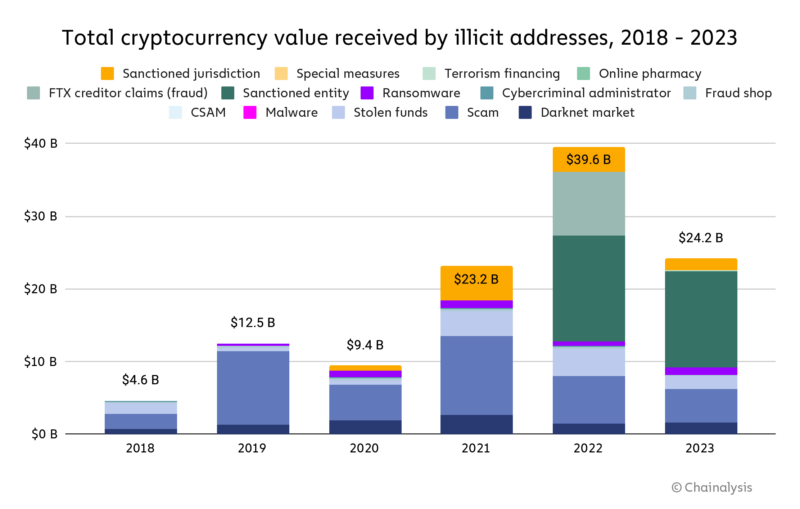

A report from blockchain analytics firm Chainalysis has highlighted a concerning trend in the realm of cryptocurrency, with illicit addresses transferring a staggering $22.2 billion into cryptocurrencies in 2023. This figure represents a decrease from the $31.5 billion laundered in 2022, according to the report titled “2024 Crypto Crime Money Laundering Report.” Despite the reduction, the figures underscore the ongoing challenges within the industry to curb money laundering activities.

Cryptocurrencies have paved a new path for money laundering, challenging the conventional methods traditionally used to conceal the origins of illicit funds. Central to this challenge is the inherent transparency of blockchain technology, which ensures that all transactions are visible to the public. However, despite this visibility, criminals continue to devise sophisticated methods to obscure the trail of their funds, with the aim of converting their illicitly obtained cryptocurrencies into fiat currency without detection.

The adoption of cryptocurrencies for illicit transactions has been one of the key reasons behind the intensified crackdown on cryptocurrencies. For example, Nigerian authorities have recently taken steps to regulate cryptocurrency exchanges in an effort to combat financial market manipulation and money laundering.

Nonetheless, further research indicates that while the volume of money laundered through cryptocurrencies is substantial, it has yet to surpass the amounts of illicit money moved through traditional cash transactions.

Further details from Chainalysis’s report reveal that illicit addresses transferred $22.2 billion of cryptocurrency to various services in 2023, marking a significant decrease from the $31.5 billion recorded in 2022. This indicates some progress in the fight against crypto-related money laundering, but also highlights the need for continued vigilance and innovation in anti-money laundering efforts within the cryptocurrency space.

Chainalysis attributes the decline in cryptocurrency laundering partly to the intensive crackdowns on crypto mixers by the United States government. These mixers, which are designed to obscure the origins of illicit funds by blending them, have been a key target of regulatory enforcement actions due to their role in money laundering operations.

Notably, in August 2022, Tornado Cash, a well-known crypto mixer, was shut down, followed by a significant operation against Sinbad by the U.S. authorities in November of the same year. These actions have markedly constrained the ability of cryptocurrency launderers to utilize mixers for disguising the origins of illicit funds.

However, despite these efforts to dismantle parts of the cryptocurrency laundering infrastructure, cybercriminals continue to adapt. The Chainalysis report highlights that the Lazarus Group, a North Korean hacking syndicate, has shifted its operations to YoMix, a platform that has seen a substantial increase in activity. Since January 2024, YoMix has experienced a fivefold surge in its activities, with approximately one-third of its inflows linked to wallets associated with cryptocurrency hacks. This trend indicates the ongoing challenge of curbing the adaptability of cybercriminals in the face of regulatory pressures.

Despite the substantial amounts being laundered through cryptocurrencies, research indicates that cash, rather than cryptocurrencies, remains the preferred medium for money laundering among criminals and organizations.

A recent risk assessment report from the United States Treasury Department, focusing on money laundering, terrorist financing, and proliferation financing, underscores that criminals and transnational criminal organizations predominantly opt for cash transactions. The Treasury Department cites the anonymity, stability, and widespread acceptance of cash as the primary reasons for its continued use in laundering illicit proceeds.

“Criminals favor cash-based money laundering techniques largely due to the anonymity that cash provides. They often prefer U.S. currency because of its global acceptance and perceived stability,” according to the Treasury Department.

The report also points out that bulk cash smuggling, which involves the physical transportation of U.S. dollar banknotes, is a common strategy for laundering money both within and beyond U.S. borders.

While acknowledging that the misuse of virtual assets in money laundering is significantly less than that of fiat currency and traditional methods, the Treasury Department recognizes that cryptocurrencies are exploited in various criminal activities. These include ransomware attacks, scams, drug trafficking, human trafficking, and other illegal endeavors.

Comments 1