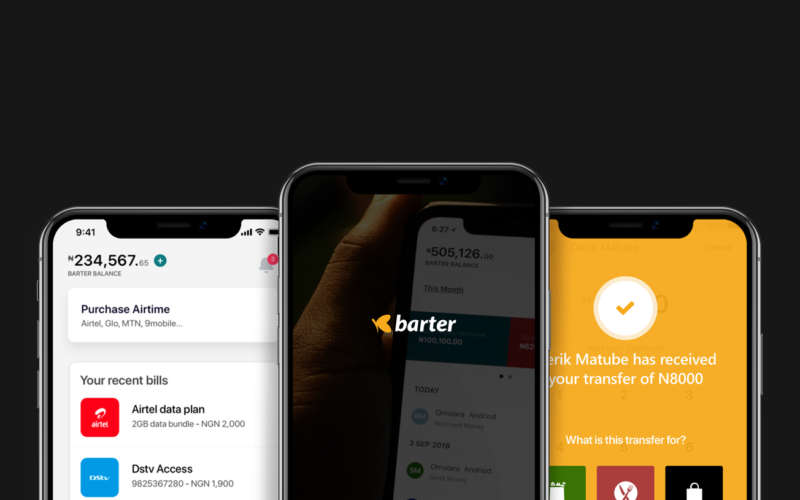

African financial technology behemoth Flutterwave has announced it will be winding down its virtual card service, Barter, a platform that was first introduced to the market in 2017. This significant shift in strategy is redirecting the company’s focus towards strengthening its remittance services and bolstering its enterprise solutions, areas where Flutterwave has already seen considerable success and growth.

This decision to pivot comes after an in-depth analysis of the prevailing market dynamics and a close examination of changing consumer preferences. Despite recognizing the inherent value that retail offerings bring to the table, Flutterwave has made the strategic decision to prioritize the enhancement and expansion of its business-centric and remittance solutions moving forward.

The discontinuation of Barter is set against a backdrop of various challenges that the platform has faced, particularly in the year 2022 when an update issued by its card partner, Union54, precipitated a significant period of downtime. This Zambian card issuer became the focus of a massive $1.2 billion chargeback fraud attempt, an incident that undoubtedly shook the foundation of trust and reliability that Barter had been building with its users.

Furthermore, users of Barter frequently encountered stability issues, alongside repeated card rejections by several key global merchants, including but not limited to Netflix, Facebook, PayPal, and Apple Music. These operational hurdles significantly impaired the user experience and, quite likely, played a pivotal role in Flutterwave’s strategic decision to phase out the Barter service.

Despite Barter’s innovative approach in offering Nigerian users and others the ability to make international payments since its inception in 2017, its impact on Flutterwave’s overarching business objectives has been minimal. The platform accounted for approximately 1% of the company’s total transaction volume—a volume that spans billions of dollars and is primarily driven by Flutterwave’s enterprise services.

As Flutterwave turns the page on Barter, the company is doubling down on its commitment to remittance services, with a keen eye on Send and Swap, two of its offerings designed to capture a significant slice of Africa’s substantial $54 billion remittance market. While the full impact of this strategic shift remains to be seen, Flutterwave is optimistic about the future, believing in the potential of its remittance and enterprise solutions to drive the next phase of its growth and expansion across the African continent and beyond.