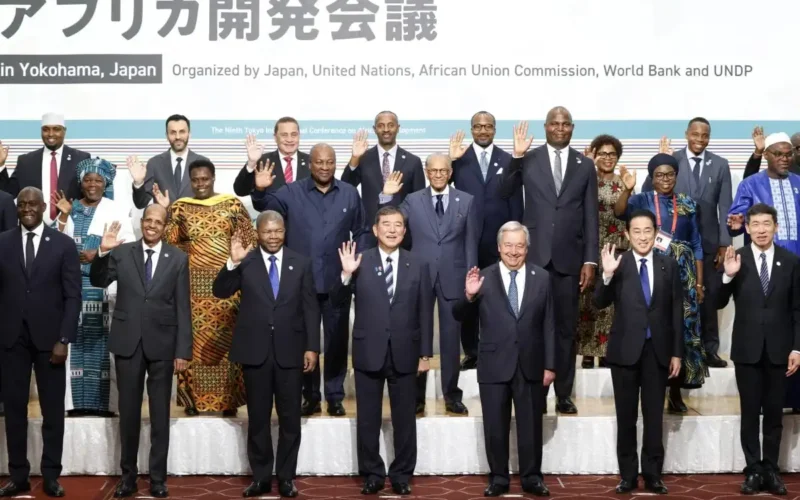

The ninth Tokyo International Conference on African Development (TICAD9) wrapped up in Yokohama on August 22, 2025, marking another chapter in what has become one of the most underestimated geopolitical relationships of our time. While the world obsesses over China’s Belt and Road Initiative and America’s belated African pivot, Japan has been quietly, methodically, and brilliantly cultivating relationships across Africa for over three decades.

But this year felt different. This year, the masks came off.

The Long Game: From Aid to Strategic Partnership

Since its launch in 1993 by the Government of Japan, TICAD has evolved from a development aid forum into “a major global and open and multilateral forum for mobilizing and sustaining international support for Africa’s development under the principles of African ‘ownership'”. What started as Japan’s answer to post-Cold War African engagement has transformed into something far more sophisticated—a masterclass in patient capital and strategic positioning.

This year’s summit in Yokohama featured a greater focus on the opportunities for Japanese businesses in Africa, including trade corridors, signaling a decisive shift from Japan’s traditional aid-heavy approach to a more business-centric model. The message was clear: Japan is no longer just a donor; it’s positioning itself as Africa’s preferred economic partner for the next century.

The Numbers Don’t Lie: 300 Agreements Signal Serious Intent

A major boost in Japan-Africa relations as 300 cooperation agreements were signed during the 9th Tokyo International Conference on Africa’s Development, or TICAD9, held this week. That’s three times more than what was achieved at the last summit in Tunisia back in 2022.

The sheer volume of agreements signed at TICAD9 tells the real story. Among the most significant:

The $5.5 Billion Private Sector Push: Japan International Cooperation Agency and African Development Bank sign agreement to extend Enhanced Private Sector Assistance initiative for $5.5 billion—a massive commitment that signals Japan’s shift from aid to investment.

Infrastructure and Human Capital: Tanzania and Japan signed a Memorandum of Understanding (MoU) on cooperation in human resource development in the construction sector, demonstrating Japan’s commitment to building both infrastructure and the skilled workforce to maintain it.

Technology Transfer Focus: The deals signed are expected to bring Japanese expertise in high-quality infrastructure, advanced technology, and disaster resilience–areas where Japan has a global reputation.

The Critical Minerals Chess Game

Here’s what most observers missed: TICAD9 wasn’t really about development aid. It was about securing Japan’s industrial future.

The Japan-led gathering took place amid intensifying competition for access to key minerals including rare earths, with critical minerals seen as essential for innovation and decarbonization. China currently dominates Africa’s critical mineral exports—72% of cobalt, 28% of graphite, and 58% of manganese—but Japan is playing a different game entirely.

While China’s approach has been aggressive and extractive, Japan’s strategy is built on long-term relationships and technological partnership. Japan’s comprehensive minerals strategy, developed after a 2010 rare earth supply disruption with China, prioritizes domestic stockpiling, research, and international partnerships, including a 2023 framework with the United Kingdom to jointly invest in African mine development.

This isn’t just about resources—it’s about reimagining the entire value chain.

What Africa Stands to Gain: The Technology Transfer Revolution

Japan’s African strategy offers something China’s checkbook diplomacy cannot: genuine technology transfer and industrial upgrading. Japanese companies aren’t just buying African minerals; they’re bringing next-generation mining technologies, environmental standards, and manufacturing capabilities that could transform African economies from commodity exporters to industrial powerhouses.

The potential benefits are staggering:

Industrial Sophistication: Japanese partnerships promise to move African countries up the value chain, from raw material exporters to manufacturers of finished goods.

Environmental Leadership: Japan’s commitment to responsible mining and green technologies could help Africa leapfrog the environmental disasters that marked earlier industrialization waves.

Innovation Ecosystems: Unlike purely extractive relationships, Japan’s approach emphasizes building local research capacity and innovation hubs.

Sustainable Development: Japan’s focus on long-term partnerships over quick wins aligns with Africa’s need for sustainable economic growth.

The Risks: Dependency 2.0

But Africa must tread carefully. Japan’s charm offensive, while more sophisticated than China’s infrastructure diplomacy, carries its own risks:

Technological Dependence: Heavy reliance on Japanese technology could create new forms of dependency, limiting African innovation and self-reliance.

Market Access Restrictions: Japanese companies might prioritize their domestic market needs over African industrial development.

Environmental Concerns: Despite promises of responsible mining, the scale of mineral extraction required for Japan’s green transition could still devastate local ecosystems.

Geopolitical Pressure: As US-China tensions escalate, Africa risks being caught in the crossfire of competing technological blocs, with Japan firmly in the American camp.

The China Factor: Competition Breeds Innovation

Japan’s renewed African focus isn’t happening in a vacuum. Tokyo is reasserting a commitment to do more business with Africa as Japanese firms look to bring new technologies to the continent, largely in response to China’s dominance in African markets.

This competition could be Africa’s greatest asset. When major powers compete for your attention, you hold the cards—if you play them right.

China offers speed and scale. Japan offers precision and sustainability. America offers market access and security guarantees. Europe offers regulatory frameworks and environmental standards. Africa’s challenge is to extract maximum value from each relationship without becoming overly dependent on any single partner.

The Verdict: A New Model for North-South Cooperation?

TICAD9 may have marked the emergence of a new model for North-South economic cooperation—one based on technological partnership rather than traditional aid or pure resource extraction. Japan’s 32-year investment in African relationships is finally bearing fruit, not through debt-trap diplomacy or military bases, but through patient relationship-building and technological cooperation.

For Africa, the question isn’t whether to engage with Japan—it’s how to ensure that engagement serves African interests first and foremost. The continent needs partners, not patrons. It needs technology transfer, not technological dependence. It needs sustainable development, not sustainable extraction.

Japan’s approach offers a path toward these goals, but only if African leaders maintain their agency and leverage their growing importance in global supply chains.

The real test isn’t what happens in Yokohama conference halls—it’s what happens in Addis Ababa boardrooms, Lagos tech hubs, and Kinshasa mining sites. Africa’s future depends on its ability to transform partnerships into prosperity, relationships into industrial capacity, and diplomatic wins into economic transformation.

TICAD9 showed that Japan is serious about Africa. Now it’s time for Africa to show it’s serious about itself.

TechMoonshot is a leading voice in African technology and innovation policy. Follow us for bold takes on the intersection of technology, policy, and African development.