Certainly, the landscape of the tech industry has witnessed a remarkable shift, with Artificial Intelligence (AI) emerging as the new focal point in the past few years. This transformation gained considerable momentum, especially in the wake of the breakthroughs brought about by OpenAI’s ChatGPT in 2022. The profound impact of AI on various sectors and its potential for innovation have not only captured the attention of technology enthusiasts but have also translated into a surge in funding.

As we delve into the ongoing narrative of 2023, the trend persists, revealing that Venture Capitalists (VCs) are unwavering in their commitment to investing substantial amounts in Artificial Intelligence companies. The allure of AI, with its capabilities to revolutionize industries, enhance efficiency, and drive innovation, has become a magnet for financial support.

This sustained inflow of funding signifies a collective belief in the transformative power of AI and its capacity to shape the future of technology. In 2023 The investments made by VCs underscore the industry’s confidence in the potential breakthroughs and advancements that AI-driven solutions can bring to the forefront.

The Artificial Intelligence (AI) industry has emerged as a beacon of resilience in the midst of a broader trend of reduced venture capital (VC) funding observed across various sectors this year. In a landscape where many markets experienced a notable decline in fundraising, AI companies and startups have emerged as the new darlings for investors, attracting a remarkable influx of fresh capital, surpassing the figures seen in the previous year.

Contrary to the prevailing economic uncertainties and fluctuations in other sectors, the AI industry has not only weathered the storm but has, in fact, experienced a surge in investor interest. This newfound attraction to AI ventures signifies a notable shift in investment preferences, where the unique potential and transformative capabilities of AI technologies have captured the imagination of financiers.

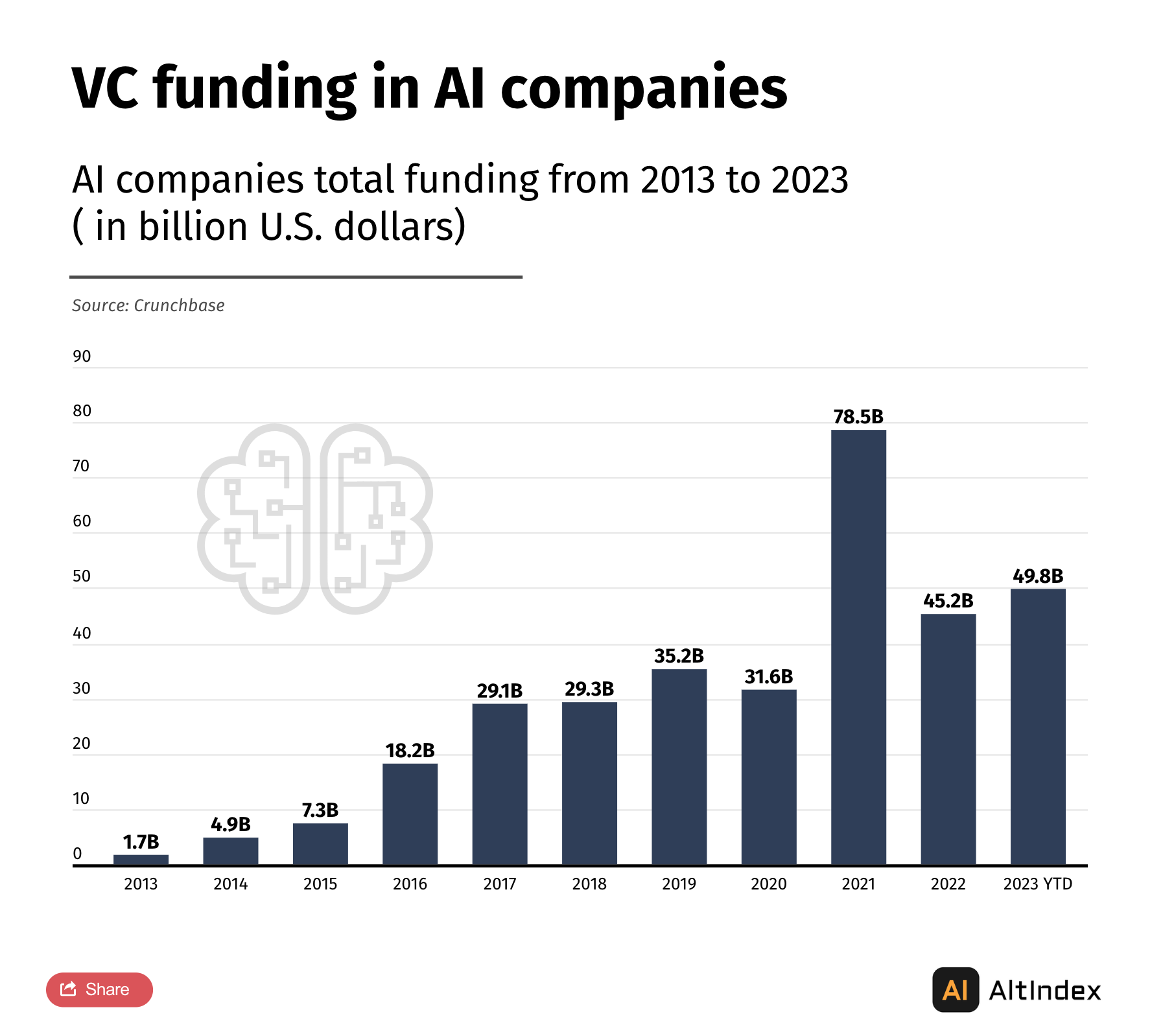

Remarkably, the data presented by AltIndex reveals a staggering accomplishment for the AI sector. Year-to-date, AI companies have collectively raised close to $50 billion, marking the second-highest figure in the market’s history. This substantial influx of capital speaks to the confidence that investors place in the trajectory and potential of AI-driven innovations.

After 2021, 2023 is The Second-Highest Year for AI Fundraising

The global AI industry has undergone a remarkable transformation, experiencing over a twofold increase in just three years, soaring to a staggering $240 billion valuation and engaging a quarter of a billion users across the globe. This phenomenal growth has sparked significant interest from venture capital (VC) investors, leading to an infusion of billions of dollars into AI companies and startups.

Despite the prevailing slowdown in overall VC funding, the AI sector has maintained robust fundraising momentum, making 2023 the second-best year for fundraising in the history of the AI market, following its exceptional performance in 2021.

Crunchbase data reveals that AI companies and startups collectively secured an impressive $78.5 billion in funding in that year alone, more than double the amount observed in 2020. While fundraising experienced a 42% year-over-year decline after the exceptional 2021, AI companies continued to secure substantial funding, raising a noteworthy $45.2 billion in 2022.

However, the latest statistics demonstrate that 2023 has surpassed its predecessors in fundraising success. Companies and startups operating in the AI space managed to secure an additional $4.5 billion compared to the previous year, culminating in a grand total of $49.8 billion. This surge in funding not only underscores the sustained growth and significance of the AI industry but also highlights its continued allure for investors seeking transformative opportunities in the rapidly evolving landscape of artificial intelligence.

Of the total, nearly 60%, amounting to $28.8 billion, was secured in the first half of the year, indicating a marginal 4% decrease compared to the corresponding period in the previous year. However, fundraising activity experienced a notable surge in the latter half of the year, with AI companies securing an additional $20.9 billion in funding rounds, marking an impressive uptick of almost 40% compared to H2 2022.

Despite the overall increase in the total funding amount by $4.5 billion year-over-year, it is noteworthy that the number of investments actually declined from the figures recorded in 2022. This implies that AI companies successfully garnered more fresh capital in a reduced number of funding rounds. The statistics reveal that the AI industry witnessed 842 VC investments in the course of the year, a decrease from the 1,101 recorded in 2022.

Total Funding for AI Companies Surpasses $333 Billion

With an exceptional nearly $50 billion amassed in funding rounds throughout the current year, the cumulative funding for the Artificial Intelligence (AI) sector has reached an impressive milestone, totaling an outstanding $333 billion.

This significant influx of capital is indicative of the sustained growth and burgeoning interest in AI technologies. Notably, approximately 55% of this staggering total, amounting to $189 billion, was directed toward companies based in the United States, with California emerging as the predominant hub for AI innovation. Meanwhile, in the dynamic landscape of Asia, the industry witnessed the second-highest value in funding rounds, amassing over $96 billion. European companies also made notable strides, securing a substantial $35.3 billion in total funding.

The distribution of funding across regions underscores the global significance of AI, as innovation and investment continue to shape and propel the industry forward. As the AI sector thrives and diversifies, these substantial funding amounts highlight the crucial role played by various regions in fostering innovation, research, and development within the field.