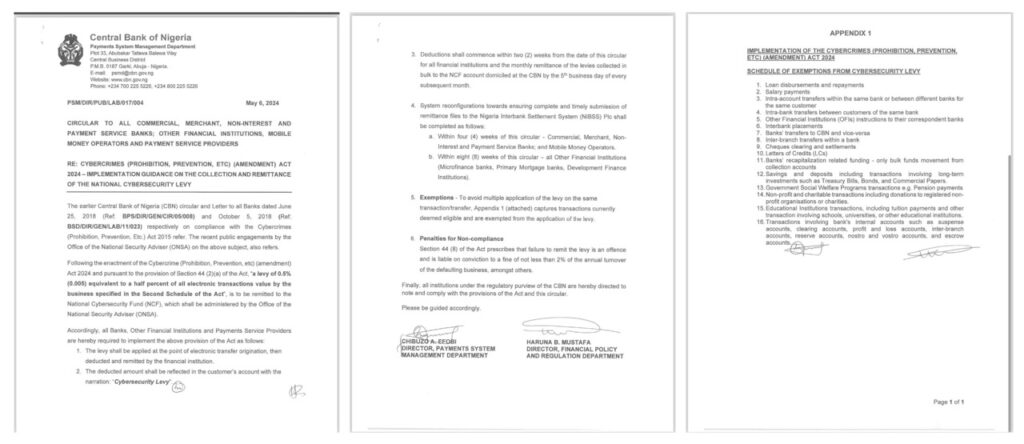

Nigerians using digital payment systems will soon incur a new levy, as the Central Bank of Nigeria (CBN) has announced a 0.5% charge on certain electronic transactions to bolster the country’s cybersecurity defenses. This measure will take effect within two weeks and is part of the recent enhancements to the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024.

The levy is designed to fund the National Cybersecurity Fund, which is managed by the Office of the National Security Adviser. It will apply to a variety of digital financial activities including online payments, electronic funds transfers, mobile money services, point-of-sale transactions, and potentially ATM withdrawals. However, the CBN has specified exemptions, including loan disbursements and repayments, salary transfers, some bank transfers, cheque clearings, and deposits into savings accounts.

While the initiative aims to strengthen cybersecurity amid rising incidents of cyber attacks on financial institutions, it has been met with criticism. Opponents argue that the additional 0.5% charge could deter the use of digital payment methods and adversely affect efforts towards financial inclusion. There are also calls for greater transparency in how the funds collected through this levy are utilized.

The CBN has emphasized the importance of compliance with this new levy, warning that businesses failing to deduct and remit the required amounts will face fines up to 2% of their annual turnover.