Global non-profit Accion has unveiled the US$152.5 million Accion Digital Transformation Fund (ADTx), designed to empower financial institutions to better serve small businesses currently underserved by the financial system. The fund aims to provide growth capital and strategic support for digital transformation initiatives.

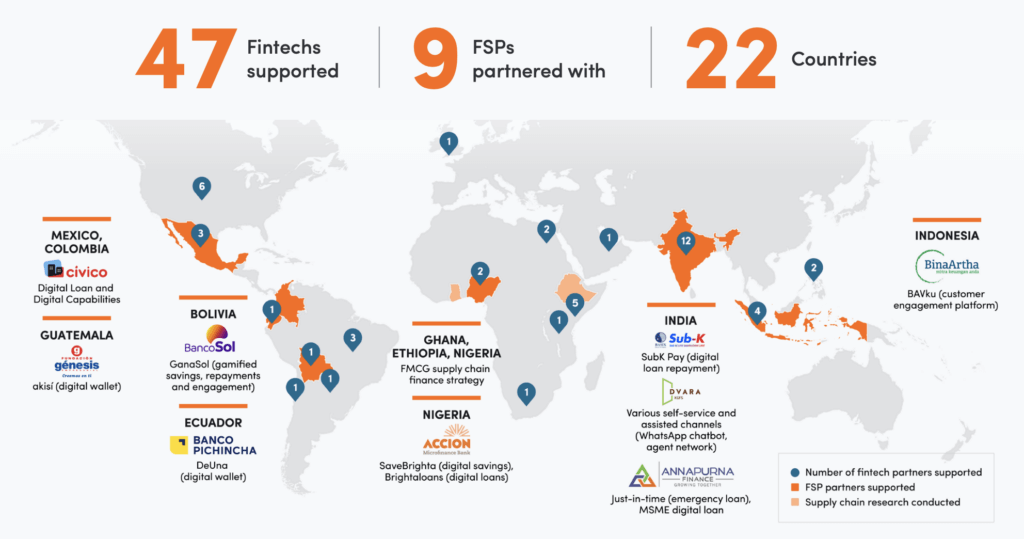

Established in 1961, Accion is committed to fostering a fair and inclusive economy for nearly two billion individuals overlooked by the global financial system. By developing and scaling responsible digital financial solutions, Accion aims to empower small business owners, smallholder farmers, and women to make informed decisions and enhance their livelihoods. The organization has played a pivotal role in establishing over 230 financial service providers across 75 countries, reaching more than 350 million people.

Managed by Accion Impact Management, the ADTx fund will leverage Accion’s extensive experience in supporting banks and finance companies worldwide to facilitate access to the digital economy for millions of small businesses and individuals. Targeting micro, small, and medium enterprises in Africa, South and Southeast Asia, and Latin America, the fund anticipates making up to 12 investments.

Key investors in the fund include British International Investment (BII), the UK’s development finance institution and impact investor; FMO, the Dutch entrepreneurial development bank; IDB Invest; International Finance Corporation (IFC); Mastercard; OeEB, the development bank of Austria; and Swedfund, Sweden’s development finance institution.

Michael Schlein, President, and CEO of Accion emphasized the critical role of leveraging third-party capital in Accion’s strategy, stating, “With global poverty on the rise for the first time in decades, Accion is on a mission to bring cheaper, customer-friendly financial solutions to the nearly two billion people who are failed by the financial system.”