There is undoubtedly a turbulent phase unfolding in the tech world, marked by the diminishing funding that once rendered it a haven for everyone within the ecosystem. And African tech ecosystem is not immune to this problem, particularly in the year 2023 which has seen a significant nosedive in its tech funding.

As the year unfolded, the tale of the Funding Drought in Africa revealed both heartbreak and triumph. While some startups succumbed to the financial tempest, others weathered the storm by adapting, pivoting, and finding creative solutions. In this article, I will highlight those that could not survive the storm.

Embarking on the journey of starting a startup is undeniably challenging anywhere in the world, and it becomes even more formidable for young Africans who must navigate a myriad of challenges inherent to the continent’s growth ambitions. As I pen down this article, I find it crucial to extend empathy and understanding to those courageous individuals who, against all odds, summon the determination to build and innovate in the face of the unique challenges that come with entrepreneurship in Africa. The narrative of their resilience and determination deserves recognition and appreciation as they contribute to shaping the future of the African startup landscape.

Venture capital funding has experienced a notable decline on a global scale in 2023. Despite initial hopes that the nascent African tech ecosystem might be spared from significant damage, the increasing size of the continent’s “startup graveyard” indicates that this is not the case.

Global venture capital funding nearly halved in the first six months of 2023, as reported by PitchBook data. This decline has been attributed to a combination of waning investor enthusiasm and reduced demand amid increasing interest rates. In the third quarter, Crunchbase data indicates a 15% decrease compared to the same quarter in the previous year.

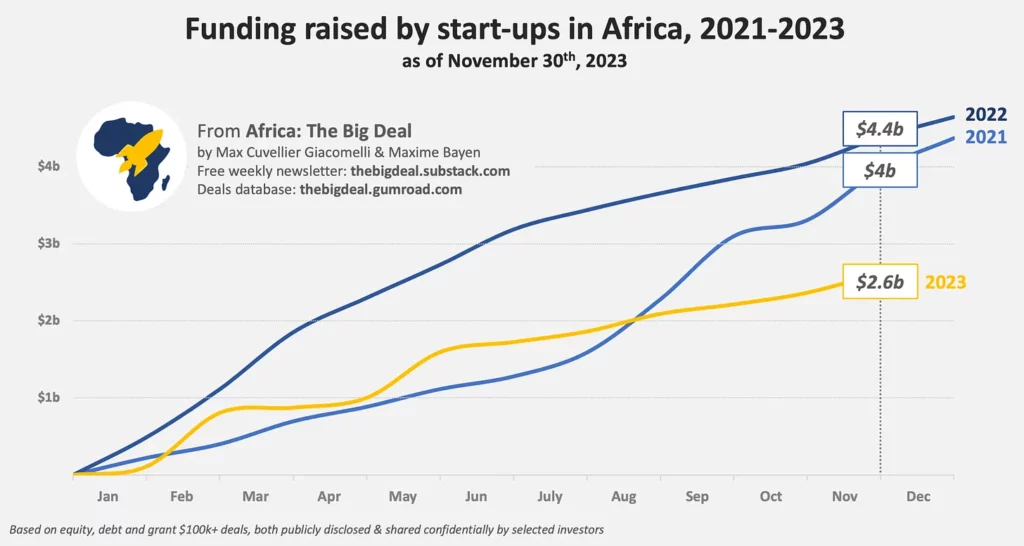

In Africa, the figures for tech funding present a concerning narrative. Tech startups in Africa secured slightly less than US$500 million in Q3, bringing the total for the first nine months of the year to just under US$1.5 billion. This reflects a 48% decline compared to the corresponding period in 2022. Unless there is a significant upturn, it appears that funding in 2023 will be approximately half of last year’s, marking a notable reset in the funding landscape.

The silver lining for African tech is that this downright drop in startup funding is experienced in other regions, as reported by the Economic Times European tech startup funding is to fall to $45 billion in 2023 from $82 billion in 2022. Of course, there is no good comparison as each geography is unique, and in any case, comparison is the thief of joy as they say.

As experts delve into the intricacies of funding dynamics, a discernible trend emerges, underscoring the fact that Africa, in the realm of financial support for its burgeoning tech ecosystem, remains relatively underfunded when juxtaposed against other global counterparts.

Funding insights from data tracker The Big Deal showed a significant contrast as expected between 2022 and 2023 as of November this year.

Here are the 15 well-known startups that shut down in 2023.

Lazerpay (Crypto)

In April, Lazerpay, a Nigerian crypto and web3 company, faced the unfortunate necessity of shutting down its operations due to challenges in securing additional funding. The company had previously experienced setbacks, including laying off some employees the previous year after the lead investor for its seed round withdrew interest, citing “market conditions and disagreement on terms.”

In a statement obtained by Bendada.com, Njoku Emmanuel, the founder and CEO of Lazerpay, expressed the team’s tireless efforts to secure the necessary funding to sustain operations. Despite their endeavors, a successful fundraising round proved elusive, leading to the difficult decision to shut down the company.

Launched in 2021, Lazerpay operated as a crypto-focused counterpart to services like Stripe. It provided businesses with channels to accept crypto payments from their customers, offering the integration of collections widgets in their apps for seamless payment collection through links. The closure of Lazerpay marks a poignant chapter in the challenges faced by startups navigating the complex landscape of funding and market conditions.

Zumi (B2B e-commerce)

In March, Zumi, a Kenyan B2B e-commerce startup, ceased operations as it faced challenges securing additional funding to sustain its business. Originally launched in 2016 as a female-focused digital magazine, Zumi underwent a pivot in 2020, transitioning into the realm of e-commerce. The platform, functioning as an end-to-end marketplace, played a crucial role in connecting retailers with suppliers and overseeing the entirety of transactions, including payments and logistics.

Co-founder and CEO William McCarren shared that the startup had accomplished significant milestones, with over $20 million in sales, 5,000 customers, and a team of 150 people. However, the challenging macro environment made fundraising an arduous task, and unfortunately, Zumi could not attain sustainability in time to weather the difficulties, leading to the decision to cease operations. The story of Zumi reflects the intricate challenges startups face in adapting to market conditions and securing essential funding for their continued growth and existence.

Hytch (Logistics)

Nine months after initiating its operations, the Nigerian logistics startup Hytch ceased its activities in February. Co-founder Laolu Onifade explained, “We couldn’t secure [funding] and couldn’t sustain the business solely with the revenue generated.” Initially launched as a ride-hailing company, Hytch later shifted its focus to providing fulfillment services for Nigerian healthtech companies Famasi, Wicreate, and Smileys.

In the preceding year, Hytch had announced its ongoing efforts to raise pre-seed capital, following a successful family-and-friends funding round. Onifade stated, “We garnered traction…executed thousands of deliveries, but were unable to close the funding round. Despite pioneering an innovative approach with zero operational costs, we faced the challenge of building something unprecedented.”

Wabi (E-commerce)

In January, Wabi, an e-commerce startup with the backing of global beverage giant Coca-Cola, made the strategic decision to discontinue its operations in five key African markets. This significant move included the cessation of activities in prominent nations such as Nigeria, Kenya, and Egypt. Despite this regional retrenchment, Wabi remains actively engaged in conducting its e-commerce operations across a broad spectrum, maintaining a robust presence in approximately 14 other countries around the globe. This strategic realignment underscores the dynamic nature of the e-commerce landscape, as companies adapt their market strategies to evolving conditions and focus on areas that promise sustained growth and market viability.

Sendy (Logistics)

In August, Sendy, a Kenyan end-to-end fulfillment startup, made the decision to cease its operations and disclosed an asset sale, although the terminology used didn’t explicitly label it as such. Reports indicated that a combination of diminished order volumes and increases in fuel prices led to the company incurring losses on its deliveries, coupled with a substantial monthly burn rate of US$1 million. Despite having successfully raised US$20 million in capital as recently as January 2020, the prevailing economic climate proved challenging, and the company found itself unable to secure additional funding. This development underscores the impact of market dynamics and external factors on the sustainability of businesses, even those that had previously secured substantial investment.

54gene (HealthTech)

In September, 54gene, a genomics research company that had successfully secured US$45 million through three funding rounds, announced the initiation of a process to wind down its operations. The company, which had experienced a change in leadership with three CEOs in the past 12 months, cited financial challenges as the primary reason for this decision, stating that it “could not sustain its operations financially.” This development highlights the complexities and financial pressures that companies in innovative sectors such as genomics research may encounter, even with significant prior funding.

Dash (Fintech)

In October, Dash, a Ghanaian payments startup founded in 2019, officially folded despite having successfully raised an impressive US$86 million. The closure was accompanied by allegations of financial impropriety and false reporting, adding a layer of controversy to the startup’s demise. This turn of events underscores the challenges that businesses, even those with substantial financial backing, can face, particularly when integrity and transparency come into question.

WhereIsMyTransport (Public Transit)

In October, WhereIsMyTransport, a South African mobility startup that had received substantial funding, exceeding US$27 million from investors including Naspers in recent years, revealed its decision to shut down. The closure was attributed to the company’s inability to secure additional investment despite its previous financial backing. This development emphasizes the critical role continuous funding plays in the sustainability of startups, even those with notable support from prominent investors.

Zazuu (Fintech)

Recently, Zazuu, a London-based marketplace catering to African remittance companies, concluded its operations. Despite having secured over US$2 million in total funding, the closure was attributed to a shortage of additional funding. In a LinkedIn post, the company expressed the thorough consideration given to exploring every available option before arriving at this decision. This instance underscores the challenges faced by startups, even those with substantial funding, and highlights the importance of sustained financial support for their continued viability.

Okada Books (Publishing/Media)

Last month, Okada Books, a trailblazing digital publishing and bookselling platform founded in 2013 in Nigeria, officially ceased its operations. The closure was attributed to challenging macroeconomic conditions, as stated by Okechukwu Ofili, the company’s CEO, in a social media statement. Despite diligent efforts to explore various avenues to sustain their virtual bookshelves, the company faced insurmountable challenges. This development highlights the impact of broader economic factors on innovative ventures and underscores the difficulties faced by companies operating in the digital publishing space.

Pivo (Fintech)

Founded by Ijeoma Akwiwu and Nkiru Amadi-Emina in July 2021 and publicly launched in beta in September of the same year, Pivo initially provided banking services tailored for small supply chain businesses. Having successfully raised a US$2 million seed round just over a year ago, the startup has recently ceased its operations. Reports suggest that, in addition to external factors, internal founder conflicts played a role in the decision to close its doors. This instance underscores the multifaceted challenges that startups can encounter, encompassing both external market dynamics and internal team dynamics.

Bundle Africa (Crypto)

In July this year after three years of operation, Bundle Africa decided to cease its exchange services. The social payments app, catering to both cash and cryptocurrency transactions, made this announcement through a statement on its website that it will cease to operate. The decision which was driven by a strategic business restructuring came from the consensus of the company’s shareholders as stated by the company.

Bundle Africa’s decision to cease its exchange services came at a time when African crypto-related startups were having a hard time, with the likes of Nextcoin, Lazerpay, etc having shut down as well.

Vibra (Crypto)

VIBRA, the cryptocurrency trading app developed by the African Blockchain Lab had reportedly ceased its operations in Nigeria in July. Vincent Li, co-founder of the African Blockchain Lab, which had secured $6 million in VC funding from investors like Lateral Frontiers and Dragonfly Capital, informed the public via its website that the company underwent a significant transformation, though he didn’t disclose specifics.

Redbird (HealthTech)

Redbird was a health startup that partnered with pharmacies and licensed chemical shops to bring proven rapid test technology for chronic and acute conditions. The company was founded by Patrick Beattie and Andrew Quao in 2018. In 2021, the company raised $1.5 Million from the Johnson & Johnson Foundation, Newton Partners (through the Imperial Venture Fund), and Founders Factory Africa.

Contradictory reports circulated regarding the operational status of the company in 2022, fueling speculation about its potential shutdown. However, clarity was provided when the official announcement was made earlier this year, confirming the veracity of the information. The timing of this announcement served to dispel uncertainties and bring transparency to the situation surrounding the company’s continuity or cessation of operations.

DropX (Logistics)

Earlier this month, Techmoonshot reported on a significant development within the Nigerian tech landscape, revealing that the logistics startup DropX has officially announced its decision to cease operations. The company attributed this strategic move to the challenges posed by intense competition within the logistics sector, where other startups boasted a competitive edge and presumably outperformed DropX in various aspects.