Nigerian fintech startup Cleva is potentially the inaugural African company to be showcased in Y Combinator’s 2024 winter batch directory. On Monday, Cleva disclosed a $1.5 million pre-seed funding round aimed at enabling the establishment of USD accounts for African users, beginning with Nigeria, to facilitate international payments.

According to Tolu Alabi, “The challenge Cleva aims to address, facilitating international payments, is not confined to Nigeria or Africa. It’s a global issue; individuals in Latin America, Asia, and even Canada require the ability to receive dollars for their work and services. We’re commencing in Nigeria due to our familiarity with the market, and it’s a substantial market. However, leveraging our backgrounds, we believe we are well-equipped to address this issue on a global scale.”

The pre-seed funding was spearheaded by 1984 Ventures, a San Francisco-based venture firm, joined by The Raba Partnership, Byld Ventures, and FirstCheck Africa.

Cleva enters competition with other African startups such as Payday (recently acquired by Bitmama), Geegpay, and Grey Finance, all providing comparable banking solutions for freelancers and users across the continent. Setting itself apart, Cleva emphasizes user-friendliness—enabling users to open a USD account within minutes. The platform is built by experts with over 10 years of experience within the US banking system, ensuring affordability with capped deposit charges not exceeding $20. Additionally, Cleva is customer-centric, committed to delivering the best USD banking experience, as stated on its website.

“We are dedicated to exceeding our customers’ expectations for a seamless experience. As per the feedback we’ve received, customers appreciate our prompt responsiveness—knowing that when they contact us, it won’t take one or two weeks,” Alabi shared with TechCrunch.

Currently, Cleva users can accept ACH or domestic wire payments from any US bank account. Freelancers also have the convenience of receiving payments from various platforms, including Payoneer, Upwork, Deel, Fiverr, Amazon, and more.

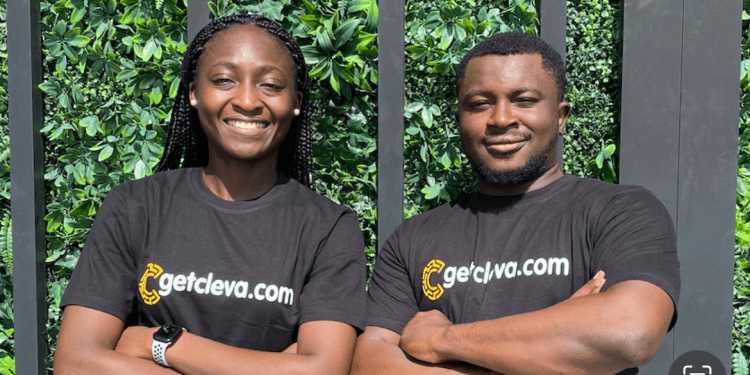

Established in August 2023 by Tolu Alabi and Philip Abel, former employees at Stripe and AWS, this Nigerian fintech is officially registered as a Money Service Business (MSB) with the US Financial Crimes Enforcement Network (FinCEN). Since its inception, Cleva claims to have processed over $1 million in monthly payments, achieving a remarkable 100% month-on-month revenue growth.

“The team is uniquely qualified to address this given their experience building banking products at Stripe and robust platforms at AWS. The impressive early growth is a testament to the team’s unique capacity to execute across Africa and the US,” says Aaron Michael, partner at 1984 Ventures.