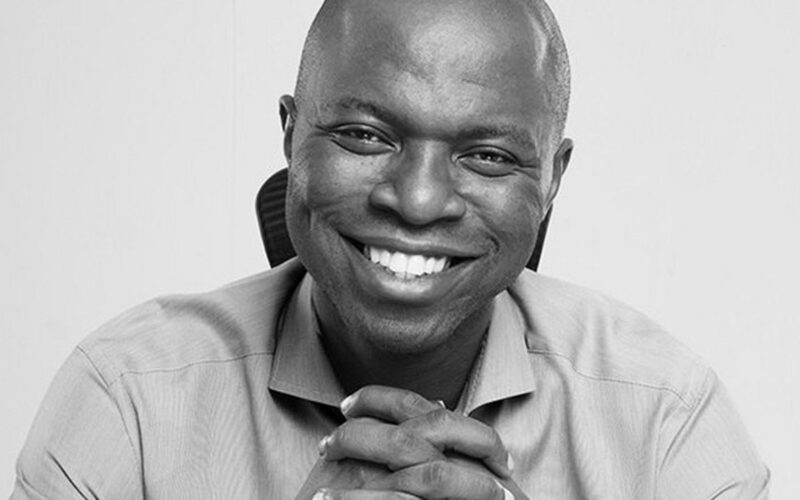

Sim Shagaya, renowned for pioneering Nigeria’s e-commerce sector through Konga and later steering the edtech startup uLesson, has embarked on a new endeavor named The Honey Badger Fund (HBF). This initiative is designed to support “extraordinary Africans” through investment in companies poised to make a positive impact across the continent. “We offer more than just capital; we bring a wealth of experience to our collaborations with entrepreneurs,” the fund states on X.

Sim’s entrepreneurial journey began with the founding of Konga in July 2012, a time when the African tech ecosystem was navigating through a capital drought. Konga successfully raised approximately $80 million before 2020, showcasing Sim’s adeptness at securing investment. Following his tenure with Konga, Sim shifted his focus to uLesson, an edtech platform he has expanded from offering primary and secondary education solutions to now encompassing tertiary education through Miva University. To date, uLesson has secured close to $30 million in funding and is at the Series B stage.

Reflecting on his experiences, Sim shared in an interview with Owvl Ventures—which spearheaded uLesson’s $7.5 million Series A round in January 2021—that he has come to understand the critical importance of discerning when it comes to accepting investment. “Not all money is good money for your business,” he noted, emphasizing the selective approach necessary for nurturing a venture’s growth.

At 48, Sim belongs to an elite cadre of Nigerian founders who have successfully navigated the venture-backed landscape with multiple companies. He expressed his eagerness to leverage his amassed knowledge to assist remarkable African entrepreneurs in building successful businesses and mastering the challenging yet rewarding journey toward business leadership. This ambition was highlighted in a tweet announcing the launch of HBF.

Sim Shagaya’s venture joins a growing list of African entrepreneurs who have transitioned into the investment space. Notables include Iyinoluwa “E” Aboyeji (Andela, Flutterwave) with Future Africa and Accelerate Africa, and Opeyemi Awoyemi (Jobberman, WhoGoHost) with Fast Forward Ventures. Numerous African founders have also made private investments in startups, either individually or through their funds. In a role reversal, Yele Bademosi, founding partner of Microtraction, ventured into the operational realm with Nestcoin, further illustrating the dynamic interplay between entrepreneurship and investment within Africa’s burgeoning tech ecosystem.