The comprehensive data collected by The Big Deal, an African tech funding tracker, meticulously outlined every funding round that took place in the first half of the year, providing an in-depth analysis in its latest report.

This report serves as a vital resource for understanding the financial landscape of the tech industry across the African continent, offering detailed insights into the amounts raised, the stages of the deals, and the sectors that attracted the most interest from investors.

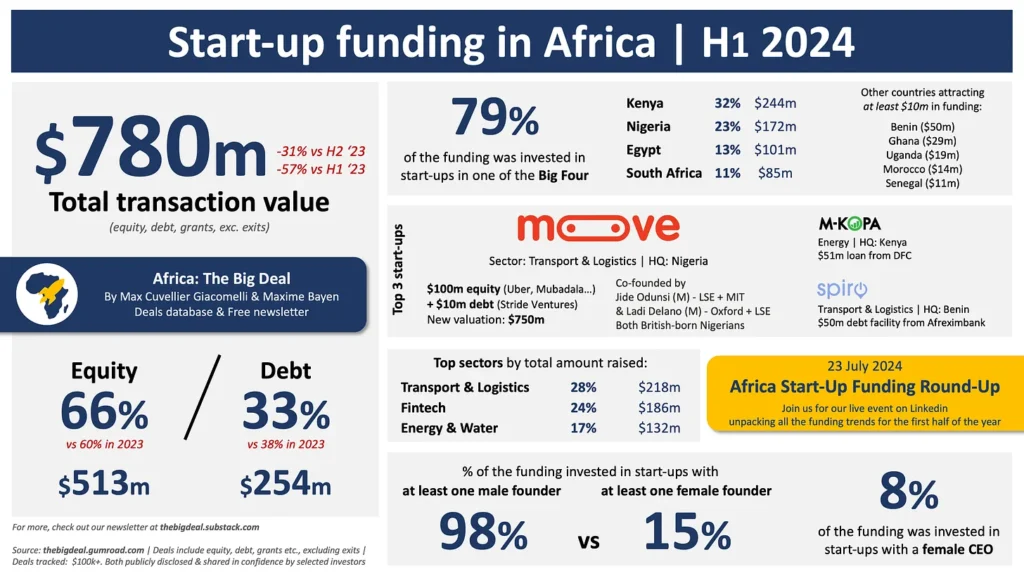

In a not-so-surprising report recently released, the first half of this year has been the quietest semester for start-up funding in Africa since late 2020. African funding winter deepens as startups raise only $780 million in the first half of 2024.

The latest data presents a comprehensive look at the current funding landscape and highlights several key trends and statistics.

1️⃣ Total Funding Raised: During the first six months of 2024, African start-ups raised a total of $780 million, excluding exits. This figure represents a significant decrease of 31% compared to the second half of 2023, and a dramatic drop of 57% compared to the same period last year. This downturn suggests a cautious approach by investors amid global economic uncertainties and market volatility.

2️⃣ Equity vs. Debt: An analysis of the funding composition reveals that two-thirds of the total capital raised was through equity investments, while the remaining one-third was obtained through debt financing. This ratio highlights the continuing preference for equity over debt in the African start-up ecosystem, despite the challenges in raising capital.

3️⃣ Geographic Concentration: Investment remains heavily concentrated in the so-called Big Four countries—Nigeria, South Africa, Egypt, and Kenya. These four nations alone accounted for an impressive 80% of the total funding. This concentration underscores the disparity in start-up activity and investment across the continent, with other regions continuing to struggle to attract substantial funding.

4️⃣ Sector Highlights: The Transport & Logistics sector emerged as the leading recipient of funding during this period, attracting significant investor interest. Conversely, the Fintech sector, while not leading in total funding, saw the highest number of start-ups raising $1 million or more. This indicates a diverse interest in various sectors, though traditional industries like Fintech continue to draw significant attention.

5️⃣ Female-led Start-ups: Despite ongoing efforts to promote gender diversity in the entrepreneurial space, funding for female-founded and female-led start-ups remained disappointingly low. Only 15% of the total funding was directed towards female-founded ventures and a mere 8% towards those led by women. This gender gap highlights the persistent challenges faced by female entrepreneurs in securing investment.

These trends provide a crucial snapshot of the current state of the African start-up ecosystem. They reflect broader economic trends and underscore the need for targeted efforts to support diverse and emerging start-up regions and sectors.

As the year progresses, stakeholders will be closely watching to see if the second half of 2024 can reverse this downward trend and reignite investor interest in the continent’s innovative ventures.