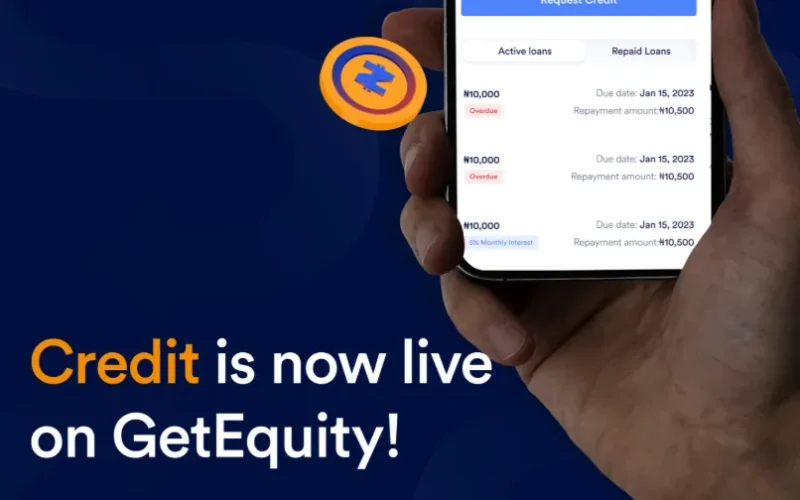

GetEquity, Nigeria’s leading digital investment platform, has announced the launch of its new Credit feature, powered by Carrot Credit. This innovative service allows investors to access loans using their existing GetEquity investments as collateral, eliminating the need to liquidate holdings.

What Is GetEquity Credit?

The new Credit feature represents a significant advancement in investment flexibility for Nigerian investors. Rather than selling investments to access cash, users can now borrow against their portfolio while their assets continue to generate returns.

GetEquity, which has been transforming how Nigerians invest in alternative assets, is now bridging the gap between long-term investing and short-term liquidity needs. This move aligns with broader trends in African fintech innovation where platforms are evolving beyond single-purpose services.

Key Features of the Credit Service

Credit Limits and Usage:

- Available Total Credit Limit displays prominently in the app

- Credit Limit Used shows current borrowing

- Real-time tracking of repayment dates

- Simple “Request Credit” process

Eligible Investments: The platform accepts various investment types as collateral, including:

- Debt instruments (Coronation Merchant Bank)

- Real estate bonds (Keble Real Estate Bond)

- Fixed interest securities (Nigerian Treasury Bills)

- Commercial paper (Payaza Africa Limited Series 4)

How GetEquity Credit Works

The credit system is straightforward and user-friendly. According to Carrot Credit, the technology provider behind this service, the platform uses sophisticated algorithms to calculate credit limits based on investment portfolios.

The process works as follows:

- Check Available Credit: View your available credit limit based on your investment portfolio

- Request Credit: Submit a loan request through the mobile app

- Maintain Investments: Your investments remain active and continue earning returns

- Flexible Repayment: Track repayment schedules with monthly interest options as low as 3%

According to the app interface, users can manage both Active loans and Repaid Loans from a single dashboard, with clear visibility of due dates and repayment amounts.

Benefits for Investors

Liquidity Without Liquidation: The primary advantage is accessing cash without disrupting long-term investment strategies. This is particularly valuable for investors who need short-term liquidity but want to maintain their investment positions. Financial experts consistently advise against liquidating performing investments for short-term cash needs when alternatives exist.

Continued Returns: Since investments aren’t sold, they continue generating returns even while being used as collateral. This means investors can potentially earn more than the cost of borrowing, especially with longer-term, higher-yield investments.

Quick Access to Funds: The digital platform enables faster loan processing compared to traditional banking channels, making it ideal for emergency expenses or time-sensitive opportunities. In Nigeria’s evolving digital lending landscape, speed and convenience are becoming critical differentiators.

Competitive Interest Rates

The platform advertises interest rates as low as 3% monthly interest on certain loans, making it a competitive option compared to traditional personal loans or payday lending services in Nigeria. For context, traditional bank lending rates in Nigeria can be significantly higher, especially for unsecured loans.

GetEquity’s Growing Ecosystem

This credit feature expands GetEquity’s offerings beyond its core investment platform. The company, founded as part of Nigeria’s thriving startup ecosystem, has been steadily building a comprehensive financial ecosystem that includes:

- Investment opportunities in bonds, treasury bills, and real estate

- Portfolio management tools

- Now credit services for enhanced liquidity

The partnership with Carrot Credit brings specialized lending expertise to GetEquity’s platform, combining investment technology with credit services. Carrot Credit has been making waves in the African lending technology space, providing infrastructure for embedded finance solutions.

Market Context

Nigeria’s fintech sector has seen explosive growth, with investment platforms increasingly adding complementary financial services. According to recent reports on African fintech, the continent’s digital financial services market is expected to reach $150 billion in revenue by 2025.

GetEquity’s move follows a broader trend of platforms offering holistic financial solutions rather than single-purpose services. Similar to how Robinhood evolved in the US market, African investment platforms are expanding their service offerings to increase user engagement and lifetime value.

The credit feature addresses a common pain point for investors: the choice between maintaining investments and accessing needed cash. By eliminating this trade-off, GetEquity positions itself as a more versatile financial platform in line with global wealth-tech trends.

Getting Started

Existing GetEquity users can access the Credit feature through the GetEquity mobile app. New users can download the app and begin investing to build eligibility for credit services.

The platform’s interface shows that credit calculations are transparent, with users able to see exactly how their credit limit is determined through the “How is my credit limit calculated?” information link.

The Future of Investment-Backed Lending

GetEquity’s launch represents a growing trend in African fintech: investment-backed lending. This model, which has proven successful in developed markets like the US, benefits investors by providing liquidity while maintaining investment positions, and it benefits lenders by having collateralized loans with lower risk profiles.

As digital investment platforms mature, services like credit facilities become differentiators in an increasingly competitive market. According to industry analysis, Nigeria’s investment-tech sector is attracting significant venture capital as platforms race to offer comprehensive financial solutions.

GetEquity’s integration of credit services signals its ambition to become a comprehensive financial platform rather than just an investment marketplace. This aligns with the vision of financial inclusion advocates who see integrated platforms as key to bringing more Africans into formal financial systems.