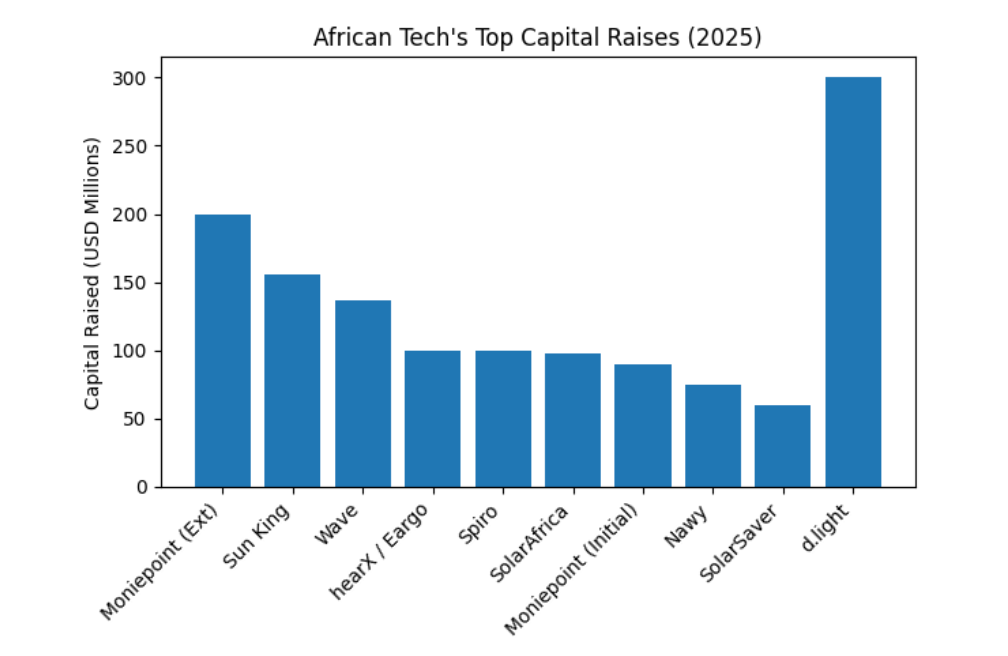

After two consecutive years of decline, African tech funding staged a remarkable comeback in 2025, crossing the $3 billion mark for the first time since 2022. This represents a 36% increase from 2024’s $2.2 billion haul, signaling renewed investor confidence in the continent’s startup ecosystem.

According to data from Africa: The Big Deal, the rebound was characterized by a shift toward larger, more strategic funding rounds—with mega-deals above $50 million becoming the new normal. Here’s a detailed look at the top 10 capital raises that defined African tech’s resurgence in 2025.

1. Moniepoint — $200 Million (Series C Extension)

Country: Nigeria

Sector: Fintech

Total Raised in 2025: $200M (plus $110M raised in late 2024)

Lead Investors: Development Partners International (DPI), LeapFrog Investments

Nigerian fintech Moniepoint closed 2024 as Africa’s newest unicorn with a $110 million Series C that valued the company above $1 billion. The momentum continued into 2025 with an additional $200 million round in October, bringing total Series C funding to over $310 million.

The company processes more than $250 billion in annual transaction value for over 10 million businesses and individuals across Nigeria. Unlike many fintech unicorns that prioritize growth over profitability, Moniepoint achieved the rare feat of being profitable at scale—making it the first African fintech to achieve unicorn status while maintaining positive unit economics.

Other investors in the extended round included Visa, IFC, Google’s Africa Investment Fund, Verod Capital, and Lightrock. The capital is fueling Moniepoint’s expansion beyond Nigeria, starting with Kenya through its acquisition of digital payments platform KopoKopo.

2. Sun King — $156 Million (Securitization)

Country: Kenya

Sector: Clean Energy

Structure: Debt/Securitization

Key Backers: ABSA, Citi, KCB Bank, Stanbic Bank Kenya, British International Investment

Sun King’s $156 million securitization in July marked the largest and first majority commercial-bank-backed deal of its kind in Sub-Saharan Africa outside South Africa. The Kenya-based off-grid solar company structured the financing to enable 1.4 million low-income households to access electricity through pay-as-you-go solar systems.

What makes this deal particularly significant is its composition: the senior tranche was funded by five commercial African banks (ABSA, Citi, Co-operative Bank of Kenya, KCB, and Stanbic), while development finance institutions (BII, FMO, and Norfund) provided the mezzanine financing. This blended structure demonstrates how African banks are increasingly viewing renewable energy infrastructure as a bankable asset class.

Sun King operates in 11 African countries and has extended $1.3 billion in solar loans to nearly 10 million customers. The company followed this securitization with a $40 million equity round from Lightrock in December, further solidifying its position as Africa’s largest off-grid solar provider.

3. Wave — $137 Million (Debt Financing)

Country: Senegal

Sector: Fintech (Mobile Money)

Structure: Debt

Lead Investor: Rand Merchant Bank (RMB)

Senegal’s Wave, Francophone Africa’s first unicorn, raised $137 million in debt financing in June to expand its mobile money operations across West Africa. The round was led by South Africa’s Rand Merchant Bank, with participation from development finance institutions including British International Investment, Finnfund, and Norfund.

Wave serves over 29 million monthly active users across eight West African markets through a network of 150,000 agents. The company’s low-fee model—charging just 1% for money transfers compared to the industry standard of up to 10%—has disrupted the telecom-dominated mobile money sector.

Since achieving unicorn status in 2021 with a $200 million Series A (the largest ever for an African startup at the time), Wave has been the only African company on Y Combinator’s Top 50 earning startups list for two consecutive years (2023 and 2024), validating both its growth and profitability.

4. hearX/Eargo Merger — $100 Million

Country: South Africa (merged with US-based Eargo)

Sector: Healthtech

Structure: Merger + Equity

Lead Investor: Patient Square Capital

South African healthtech pioneer hearX Group merged with US-based hearing aid manufacturer Eargo in April to form LXE Hearing, backed by a $100 million investment from Patient Square Capital. This marked the first major consolidation in the over-the-counter (OTC) hearing aid market since the FDA created the regulatory category in 2022.

Founded in Pretoria in 2015, hearX developed the Lexie hearing aid brand, which was among the first OTC hearing aids to hit the US market. The company’s mobile-based hearing screening technology and affordable Bose-powered hearing aids addressed a massive market—44 million American adults experience hearing loss, yet most don’t use hearing aids due to cost and accessibility barriers.

The merger represents one of the largest tech deals in South African history, with hearX CEO Nic Klopper leading the combined entity. HAVAÍC, a South African VC firm that backed hearX since 2019, called it a milestone for African innovation breaking into global markets.

5. Spiro — $100 Million

Country: Multi-country (operates in 6 African nations)

Sector: E-Mobility

Lead Investor: Fund for Export Development in Africa (FEDA/Afreximbank)

Spiro’s $100 million raise in October represented Africa’s largest-ever investment in electric vehicle mobility. The Dubai-headquartered but Africa-focused company secured $75 million from FEDA (the impact investment arm of Afreximbank) with the remaining $25 million from strategic investors.

The e-mobility startup operates the continent’s largest battery-swapping network, with over 60,000 electric motorcycles deployed across Kenya, Uganda, Rwanda, Nigeria, Benin, and Togo. Spiro’s 1,500 swap stations enable riders to exchange depleted batteries for charged ones in under two minutes.

In African cities, motorcycle taxis (boda bodas in Kenya, okadas in Nigeria) are essential infrastructure. Spiro’s value proposition is compelling: its electric bikes cost 40% less upfront than gasoline models ($800 vs. $1,300-$1,500) and reduce per-kilometer operating costs by 30%. Riders logging 150-200 kilometers daily save significantly on fuel expenses.

The company aims to deploy more than 100,000 electric bikes by end of 2025—a 400% year-over-year increase. Prior to this round, Spiro had raised $180 million from Equitane Group and Société Générale.

6. SolarAfrica — $98 Million

Country: South Africa

Sector: Clean Energy/Solar

Structure: Project Finance

Purpose: SunCentral project development

South African independent power producer SolarAfrica secured $98 million to launch the first phase of its SunCentral project, which aims to generate 1 gigawatt of solar power. The initial funding will develop the first 144 megawatts of capacity.

The financing comes at a pivotal moment as South Africa encourages private-sector participation in power generation to address its chronic electricity crisis. The country’s load-shedding challenges have created massive demand for reliable, distributed solar solutions, making it a hotbed for clean energy investment.

SolarAfrica’s project represents the type of infrastructure-scale renewable energy development that’s attracting both commercial banks and development finance institutions to the African cleantech sector.

7. Moniepoint (Initial Unicorn Round) — $90 Million

Country: Nigeria

Sector: Fintech

Round: Series C (Initial tranche, late 2024/early 2025)

Lead Investors: Development Partners International, Google’s Africa Investment Fund

While Moniepoint’s $110 million unicorn-making round closed in late October 2024, approximately $90 million of disbursements occurred in early 2025 as part of the tranched structure. This portion of funding officially pushed the company past the unicorn threshold and fueled its 2025 expansion initiatives.

The timing matters: Moniepoint became Africa’s newest unicorn at a time when the funding winter was supposedly still in effect. The company’s profitability, processing over 800 million monthly transactions worth $17 billion, made it an outlier—proving that fundamental business metrics still attract capital even in challenging markets.

8. Nawy — $75 Million

Country: Egypt

Sector: Proptech

Structure: $52M equity + $23M debt

Lead Investor: Partech Africa

Egyptian proptech Nawy raised $75 million in May (combining a $52 million Series A with $23 million in debt from major Egyptian banks), marking one of the largest Series A rounds ever recorded for an African startup.

Founded in 2019 by CEO Mostafa El Beltagy, Nawy evolved from a property listings platform into a full-stack real estate ecosystem. The company’s products now include Nawy Now (mortgage financing), Nawy Shares (fractional ownership starting at $500), and Nawy Partners (B2B tools for brokerages).

Egypt’s real estate market presented unique challenges: fragmented listings, broker distrust, and developer skepticism. Nawy solved this by offering upfront commission payments to brokers completing their first transaction, catalyzing adoption. The platform now attracts over 1 million monthly visitors, with 3,000+ brokerages using its tools.

Despite Egypt’s currency crisis—the pound lost nearly 70% of its value in recent years—Nawy remained profitable and closed 2024 with over $1.4 billion in gross merchandise value, up from $38 million in 2020. The company plans to expand into Morocco, Saudi Arabia, and the UAE.

9. SolarSaver — $60 Million

Country: South Africa

Sector: Clean Energy/Solar

Purpose: Energy deployment and scaling

South African solar energy provider SolarSaver raised $60 million in November to scale its residential and commercial solar installation business. The funding reflects the massive demand for distributed energy solutions in South Africa, where businesses and households are increasingly turning to solar to combat unreliable grid electricity.

SolarSaver’s business model targets the middle market—providing solar-as-a-service solutions that allow customers to access clean energy without large upfront capital investments. The company’s growth mirrors the broader trend of embedded finance meeting infrastructure needs.

10. d.light — $300 Million (Receivables Financing Facility Expansion)

Country: Multi-country

Sector: Clean Energy/Solar

Structure: Debt/Receivables Financing

While not a traditional equity or debt round, d.light’s expansion of its receivables financing facility by $300 million represents one of the largest financing structures in African cleantech. The company uses customer payment receivables as collateral to secure working capital.

Similar to Sun King, d.light operates a pay-as-you-go solar model across multiple African countries. The expansion of its facility demonstrates how structured finance and asset-backed lending are becoming crucial tools for scaling energy access companies that require significant working capital to manage device inventory and customer financing.

Key Trends from 2025’s Top Raises

1. Cleantech Dominance

Climate and energy startups captured four of the top 10 spots, with combined funding exceeding $650 million. This reflects both the urgent infrastructure needs across Africa and the growing global climate capital flowing into renewable energy solutions.

2. Debt and Structured Finance

At least five of the top 10 deals involved debt, securitization, or blended finance rather than pure equity. This marks a maturation of Africa’s startup ecosystem, where companies with proven cash flows can access cheaper capital than traditional venture equity.

3. Local Bank Participation

African commercial banks played meaningful roles in multiple mega-deals (Sun King, Wave, Nawy), signaling that local financial institutions increasingly view tech-enabled companies as bankable investments.

4. Country Diversification

While Nigeria historically dominated African tech funding, 2025 saw geographic spread: Kenya led with $879 million, followed by South Africa ($848M), Egypt ($561M), and Nigeria ($186M) through August. The Big Four still captured 78-84% of total funding, but secondary markets like Senegal, Rwanda, and Morocco showed momentum.

5. Profitability Matters

Companies with demonstrated unit economics and paths to profitability (Moniepoint, Wave, Nawy) attracted the largest rounds. The “growth at all costs” era has definitively ended, replaced by investor focus on sustainable business models.

6. Infrastructure and Essential Services

The largest deals went to companies solving fundamental infrastructure challenges: payments, energy access, housing, and mobility. Investors prioritized startups building the “rails” that other businesses and consumers depend on.

What This Means for 2026

The 2025 rebound suggests African tech has entered a new phase—one characterized by larger, more strategic rounds for proven companies rather than widespread seed and Series A activity. Ticket sizes grew even as deal count remained relatively flat.

For founders, the message is clear: demonstrate strong unit economics, target essential services or infrastructure gaps, and consider debt or structured finance as growth capital becomes available for cashflow-positive businesses.

For investors, Africa’s “utility-first” investment cycle—focusing on payments infrastructure, logistics, climate tech, and AI-powered productivity tools—offers opportunities in sectors with clear product-market fit and paths to profitability.

If current momentum continues, 2026 could see African tech funding surpass the $4 billion mark, approaching the record $4.6 billion raised in 2022. The question isn’t whether capital will return to Africa—it already has. The question is whether this capital will fuel the next generation of billion-dollar companies solving the continent’s most pressing challenges.

Data sources: Africa: The Big Deal, TechCrunch, Disrupt Africa, Partech Africa reports, and company announcements. Funding amounts verified across multiple sources. Figures current as of December 2025.