Forget everything you think you know about African tech. The companies dominating headlines—Flutterwave, Paystack, and Andela—are yesterday’s story. They’re the established giants, the proven winners, the “boring” infrastructure plays that VCs love to cite in pitch decks.

This list isn’t about them.

This is about the startups that didn’t exist three years ago. The founders launching companies in 2022, 2023, 2024, and 2025 who are building in the wreckage of the funding winter. The ones who watched their predecessors raise $100M rounds at inflated valuations, then crash and burn when the music stopped.

These founders learned different lessons. They’re building differently. Leaner. Meaner. More pragmatic. Less “Silicon Valley playbook,” more “what actually works here.”

African startups raised $3.5 billion in 2025—a 59% jump from 2024’s brutal $2.2 billion. But here’s what changed: clean energy overtook fintech for the first time ever, capturing 53% of total funding. Average deal sizes climbed 31% as investors stopped spray-and-pray early-stage betting and started writing bigger checks to companies with actual revenue.

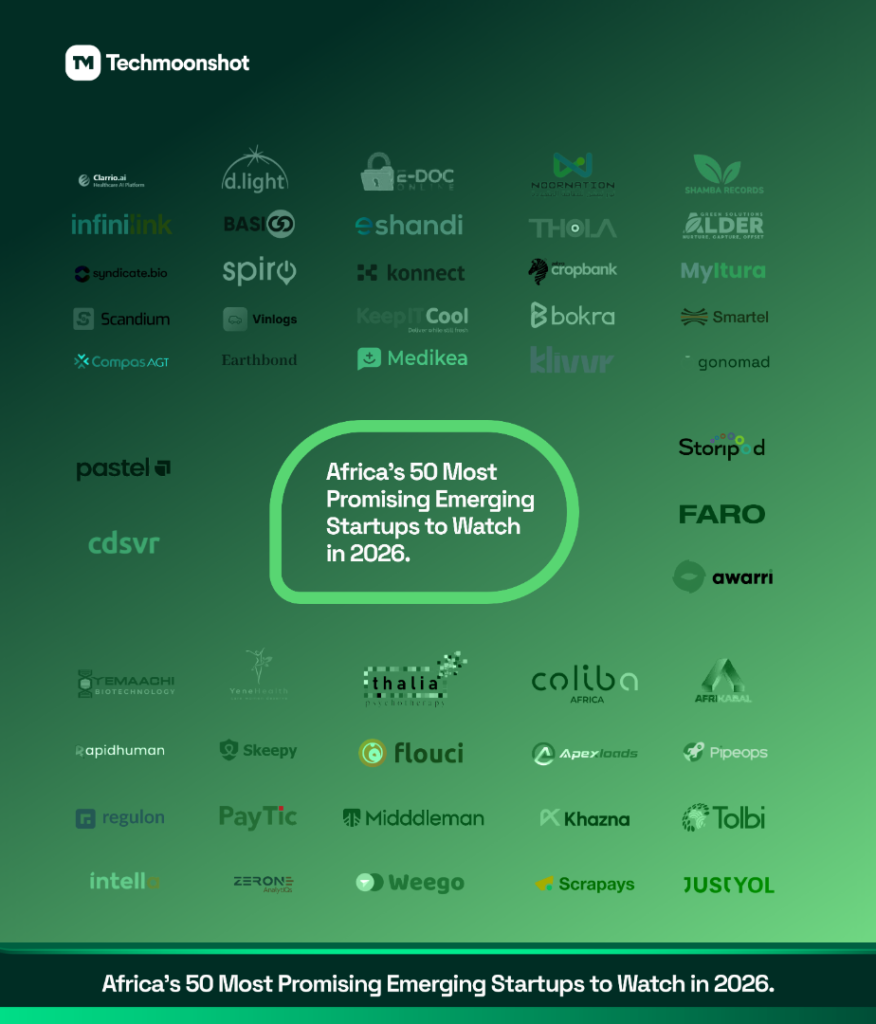

The 50 startups on this list represent Africa’s second wave. Not copycats of Western models. Not financial engineering disguised as innovation. But companies solving fundamental problems that global tech giants either can’t or won’t address.

Welcome to our emerging African startups to watch in 2026 list.

PART I: THE AI REVOLUTION

Building intelligence that speaks Africa’s languages

1. CompasAI (Nigeria, Founded: 2024)

The Pitch: Career AI that actually understands African job markets

What They Do: AGT (Aggregator) uses psychometric AI to map career paths and deliver personalized upskilling. $12/month (₦6,500 for Nigerians) gets you 60 hours of adaptive learning, WhatsApp reminders, and AI-led instruction

Why They Matter: Founder David-Bobola Ojoawo dropped out of civil engineering at University of Ibadan at age 15 after coding since he was a kid. Built automation systems and trading algorithms for European and Asian clients before this. Won Pitchfest 2024, World Summit Awards for most innovative learning platform from Nigeria

The Insight: “I realized people were paying hundreds of dollars for courses they didn’t have the potential to do,” Ojoawo said. Their aggregator runs personalized content searches in 5-10 minutes—half the time of Google Gemini

Watch For: Expansion beyond Nigeria as they prove unit economics work

2. Awarri (Nigeria, Founded: 2019, AI Lab Launched: 2023)

The Pitch: Awarri is Nigeria’s first open-source multilingual LLM

What They Do: Building N-ATLAS, a government-backed large language model trained in Yoruba, Hausa, Igbo, Ibibio, Nigerian Pidgin, and accented English. Operating LangEasy.ai platform crowdsourcing voice and text data. Over 100 locally trained AI professionals on staff

Why They Matter: Founded by Silas Adekunle (previously Reach Robotics, sold MekaMon gaming robot to Apple in 2017). This is Africa’s most ambitious AI sovereignty play. Target: 24,000 hours of audio for the first version, 500,000 hours long-term. Goal to train and hire 5,000 youth by 2026

The Insight: “There are over 7,000 languages in the world, yet fewer than 30 are represented in AI. Africa has more than 2,000 languages, but less than 2% are digitized. If we don’t act, we risk losing culture, identity, and knowledge.”

Watch For: N-ATLAS developer adoption and first consumer applications

3. Infinilink (Egypt, Founded: 2022)

The Pitch: Semiconductor chips for AI data centers

What They Do: Infinilink is building chips focused on high-speed optical connectivity for AI-driven data centers—faster and more energy-efficient data transfer between chips and servers

Why They Matter: $10M seed round led by MediaTek (Taiwanese semiconductor giant) and Sukna Ventures (Saudi VC). Founded by engineers Ahmed Aboul-Ella and Botros George. Hardware is hard, but Egypt is emerging as North Africa’s deeptech hub

The Insight: Africa accounts for 2.5% of global AI sector but infrastructure costs are prohibitive. Infinilink is betting on being the picks-and-shovels play for African AI

Watch For: First major customer announcements and manufacturing partnerships

4. Intella (Egypt/Saudi, Founded: 2021, Series A: 2025)

The Pitch: Arabic dialect speech AI

What They Do: Intella builds speech recognition and transcription specialized for Arabic dialects—crucial for customer service and content moderation across MENA

Why They Matter: $16.9M total raised, including $12.5M Series A led by Prosus, with participation from 500 Global, Wa’ed Ventures. Addressing 400M+ Arabic speakers with fragmented dialect landscape

Watch For: Regional expansion and enterprise client wins

5. Pastel (Nigeria, Founded: 2023)

The Pitch: Enterprise AI for financial institutions

What They Do: Pastel is an AI-based fraud detection and anti-money laundering tools tailored for African financial institutions

Why They Matter: Google for Startups Accelerator Africa Class 9 member. Solving compliance challenges that keep African fintechs from scaling internationally

Watch For: Major bank partnerships

6. Scandium (Nigeria, Founded: 2023)

The Pitch: AI quality assurance for software

What They Do: Scandium is an End-to-end test automation and test ops tooling enabling teams to ship bug-free software faster

Why They Matter: Google for Startups Accelerator Africa Class 9. Developer tools are unsexy but essential—and this team is Africa-first

Watch For: Enterprise SaaS adoption metrics

7. Rapid Human AI (South Africa, Founded: 2023)

The Pitch: AI design-to-code platform

What They Do: Rapid Human AI Transforms design concepts into working code using AI, cutting development time by 80%

Why They Matter: Google for Startups Accelerator Africa Class 9. Low-code/no-code tools are exploding globally—Rapid Human is the African answer

Watch For: Developer community growth

PART II: CLIMATE TECH & ENERGY

The sector that overtook fintech

8. Spiro (Pan-African, HQ: Benin, Founded: 2022)

The Pitch: Electric motorcycles and battery-swap networks

What They Do: Spiro is an E-motorcycles for commercial riders (taxis, delivery) with battery-swapping infrastructure across West Africa

Why They Matter: $100M raise in 2023. Operating in Benin, Togo, Rwanda, Kenya, Nigeria, Uganda. Addressing 27M commercial motorcycles in Africa that burn expensive gasoline

The Model: Subscription-based—riders pay daily for bike + unlimited battery swaps. No upfront capital needed

Watch For: Pan-African expansion and manufacturing localization

9. BasiGo (Kenya, Founded: 2021, Major Funding: 2024)

The Pitch: Electric buses for African cities

What They Do: BasiGo is a Pay-as-you-drive electric buses for public transport operators

Why They Matter: $42M debt and equity raise in 2024. Operating in Kenya, Rwanda. Buses are Africa’s backbone for mass transit—electrification is inevitable

The Numbers: Each bus saves operators 40% on fuel costs, eliminates 10 tons of CO2 annually

Watch For: Ethiopia and Tanzania expansion

10. d.light (Pan-African, HQ: Kenya, Major Round: 2024)

The Pitch: Solar home systems at massive scale

What They Do: d.light is a Pay-as-you-go solar products for off-grid households

Why They Matter: $176M raise in 2024 (largest climate tech deal of the year). One of Africa’s original solar pioneers, still scaling

Watch For: New product categories beyond solar home systems

11. Earthbond (Nigeria, Founded: 2023)

The Pitch: Solar financing for SMEs

What They Do: Earthbond is a one-stop shop for small businesses needing financing for reliable solar energy

Why They Matter: Catalyst Fund portfolio. Nigeria has Africa’s worst grid reliability—businesses burn diesel generators at $0.50/kWh. Solar is cheaper at $0.20/kWh but requires upfront capital

Watch For: SME client acquisition numbers

12. Keep It Cool (Kenya, Founded: 2023)

The Pitch: Solar-powered cold storage

What They Do: Keep It Cool is an affordable cold storage and e-commerce platform reducing post-harvest food waste for smallholder farmers

Why They Matter: Won 2024 Earthshot Prize (Prince William’s $1.2M climate award). Catalyst Fund portfolio. 40% of African produce is lost to lack of cold chain

The Impact: Farmers using Keep It Cool increase incomes 30%

Watch For: Regional expansion beyond Kenya

13. NoorNation (Egypt, Founded: 2023)

The Pitch: Decentralized solar for farms

What They Do: NoorNation is a Solar energy and water solutions tailored for farming businesses and underserved communities

Why They Matter: Catalyst Fund portfolio. Egypt faces water scarcity + unreliable grid. Solar-powered irrigation is the answer

Watch For: North Africa expansion

14. Scrapays (Nigeria, Founded: 2023)

The Pitch: Digital waste collection marketplace

What They Do: Scrapays is a platform that lets individuals collect and exchange waste for money. Connecting informal waste collectors with recyclers

Why They Matter: Catalyst Fund portfolio. Nigeria generates 32M tons of waste annually, 90%+ managed informally. Scrapays digitizes and incentivizes the system

Watch For: User adoption and recycling partnerships

15. Coliba (Ghana, Founded: 2019, Major Traction: 2023-2024)

The Pitch: Waste-to-cash platform

What They Do: Coliba pays individuals for plastic collection, connecting them to recycling value chains

Why They Matter: Operating across West Africa. Part of circular economy wave addressing plastic waste crisis

Watch For: Pan-African scaling

16. Medikea (Location: Tanzania, Founded: 2023)

The Pitch: Climate-resilient healthcare supply chains

What They Do: Medikea is addressing pharmaceutical and medical supply logistics challenges exacerbated by climate impacts

Why They Matter: Catalyst Fund portfolio. Climate change disrupts health supply chains—Medikea builds resilience

Watch For: Pilot results and expansion

17. Thola (Location: South Africa, Founded: 2023)

The Pitch: Climate adaptation infrastructure

What They Do: Thola provides solutions for climate-vulnerable communities (specific focus TBD)

Why They Matter: Catalyst Fund portfolio, focused on adaptation not just mitigation

Watch For: Product-market fit demonstrations

18. Zebra CropBank (Location: Nigeria, Founded: 2023)

The Pitch: Climate-smart agriculture financing

What They Do: Zebra CropBank is an agricultural credit tied to climate-smart practices

Why They Matter: Catalyst Fund portfolio. Combines fintech + agritech + climate—the perfect trifecta for African VC

Watch For: Farmer adoption and repayment rates

PART III: FINTECH’S EVOLUTION

Regulation, embedded finance, and the infrastructure plays

19. Skeepy (Nigeria, Founded: May 2025)

The Pitch: Nigeria’s first pet HMO

What They Do: Skeepy is a subscription-based veterinary care and surgical coverage for pets, ₦200,000-₦800,000 surgical caps

Why They Matter: Ridiculous? Maybe. But it’s a perfect indicator of Nigeria’s emerging middle class. Creating a national pet database while pioneering insurance regulators haven’t touched it yet

The Bet: If you’re insuring pets, the middle class has arrived

Watch For: Subscriber growth as proxy for middle-class expansion

20. Khazna (Egypt, Founded: 2021, Banking License Application: 2025)

The Pitch: Digital bank for Egypt’s underserved

What They Do: Khazna offers wage access and financial services for gig workers and informal sector

Why They Matter: 500,000+ customers, $63M raised, applying for digital banking license from CBE (expected mid-2026). If approved, transition from fintech to full digital bank

Watch For: Banking license approval—game-changer if granted

21. Bokra (Egypt, Founded: 2021, Forbes Recognition: 2025)

The Pitch: BNPL and credit for emerging markets

What They Do: Bokra is a Buy-now-pay-later integrated with e-commerce and retail

Why They Matter: Named to Forbes Middle East Fintech 50 for 2025

Watch For: Regional expansion beyond Egypt

22. Klivvr (Egypt, Founded: 2019, Major Shift: 2025)

The Pitch: From payments to consumer finance

What They Do: Klivvr is a payment gateway that acquired consumer finance license from Egypt’s FRA in January 2025. Expanding from payments into lending

Why They Matter: $13M majority stake sale. Egypt is liberalizing financial services—first movers win

Watch For: Consumer credit product launch

23. Flouci (Tunisia, Founded: 2019, Major Expansion: 2026)

The Pitch: Mobile wallet for Francophone Africa

What They Do: Flouci is a fully licensed digital wallet in Tunisia, expanding to Morocco, Algeria, Benin in 2026

Why They Matter: Francophone North Africa is under-served compared to Anglophone markets

Watch For: Cross-border expansion execution

24. Konnect Networks (Tunisia, Founded: 2021)

The Pitch: Payment gateway for MENA

What They Do: Konnect Networks is a payment solutions provider for local and international transactions—payment links, e-commerce plugins, APIs

Why They Matter: Tunisia’s emerging fintech champion targeting growing e-commerce

Watch For: Tunisia-to-Europe payment corridors

25. eShandi (Zambia, Founded: 2020, Major Round: 2024)

The Pitch: AI-driven digital banking for Southern Africa

What They Do: eShandi is a challenger bank using AI for underwriting unbanked populations

Why They Matter: $12M from international investors to become a pan-African challenger bank. Zambia is an underrated startup market

Watch For: Cross-border expansion across Southern Africa

26. E-doc Online (Nigeria, Founded: 2023)

The Pitch: Real-time compliance and credit assessment

What They Do: E-doc Online is a data-driven platform using real-time banking data for faster financial onboarding

Why They Matter: Google for Startups Accelerator Africa Class 9. Solving KYC/AML bottlenecks killing African fintech

Watch For: B2B fintech partnerships

27. GoNomad (Nigeria, Founded: 2023)

The Pitch: Global business formation for Africans

What They Do: GoNomad enables businesses to start and run global entities, solopreneurs to invoice and get paid globally like a local

Why They Matter: Google for Startups Accelerator Africa Class 9. Addressing Pan-African entrepreneurs’ biggest pain point: cross-border operations

Watch For: Entity formation volume

PART IV: AGRITECH & FOOD SYSTEMS

Feeding Africa with data and AI

28. AFRIKABAL (Rwanda, Founded: 2023)

The Pitch: Blockchain + AI for transparent crop trading

What They Do: AfriKabal is a platform connecting farmers, logistics providers, and buyers with transparent pricing and traceability

Why They Matter: Google for Startups Accelerator Africa Class 9. Rwanda is positioning as East Africa’s agritech hub

Watch For: Transaction volume and farmer adoption

29. Shamba Records (Kenya, Founded: 2022)

The Pitch: AI platform for 50,000+ farmers

What They Do: Shamba Records uses smart credit, market access, and climate-resilient, data-driven agriculture to optimise farm operations and growth.

Why They Matter: Google for Startups Accelerator Africa Class 9. Empowering smallholder farmers with data previously only available to industrial farms

Watch For: Credit repayment rates and farmer income increases

30. Smartel Agri Tech (Rwanda, Founded: 2023)

The Pitch: Solar AI for pest detection

What They Do: Smartel is a solar-powered AI device that detects crop pests/diseases early, sending SMS alerts to smallholder farmers

Why They Matter: Google for Startups Accelerator Africa Class 9. 30-40% of African crops lost to pests—early detection changes everything

Watch For: Farmer ROI data

31. TOLBI (Senegal, Founded: 2023)

The Pitch: Satellite imagery + AI for climate-smart agriculture

What They Do: Tolbi provides precise crop yield forecasts using satellite data and AI

Why They Matter: Catalyst Fund and Google for Startups Accelerator Africa Class 9. Senegal emerging as Francophone agritech leader

Watch For: Forecast accuracy and farmer subscriptions

32. Alder (Tunisia, Founded: 2022)

The Pitch: Paying farmers to store carbon

What They Do: Alder is an AI and satellite imagery measuring soil organic carbon. Sells carbon credits, incentivizes regenerative agriculture

Why They Matter: Aligning farmer incentives with climate goals. Tunisia’s climate tech champion

Watch For: Carbon credit sales and farmer adoption in North Africa

PART V: HEALTHTECH

Expanding access to care

33. Myltura (Nigeria, Founded: 2023)

The Pitch: Remote healthcare AI platform

What They Do: MyItura enables remote care, test access, and seamless health data management across Africa

Why They Matter: Google for Startups Accelerator Africa Class 9. Post-COVID telehealth adoption is permanent

Watch For: Patient acquisition and insurer partnerships

34. YeneHealth (Ethiopia, Founded: 2023)

The Pitch: AI-driven pharmacy and healthcare app

What They Do: YeneHealth is a web and mobile app streamlining access to affordable, reliable medications and healthcare services

Why They Matter: Google for Startups Accelerator Africa Class 9. Ethiopia’s population (120M+) is massively underserved

Watch For: User growth and pharmaceutical partnerships

35. Clarrio (Pan-African R&D, Targeting US, Founded: 2024)

The Pitch: Predictive healthcare analytics

What They Do: Clarrio is an AI tackling healthcare’s “fragmented data” problem to predict and prevent hospital visits

Why They Matter: Pre-seed funding from Google and Microsoft executives. R&D in Africa, commercializing in US—reverse innovation model

Watch For: US insurer pilot results

36. Thalia Psychotherapy (Kenya, Founded: 2020, Major Traction: 2023-2025)

The Pitch: Mental health infrastructure

What They Do: Thalia Psychotherapy is partnering with local health facilities to add mental health services via technology, systems, and professional support

Why They Matter: 116M Africans live with mental health conditions. Backed by MIT Solve and Gates Foundation

Watch For: Facility partnership scaling

37. Syndicate Bio (Nigeria, Founded: 2024)

The Pitch: Biotech for Africa

What They Do: Syndicate Bio is a biotechnology research and development (founded by Abasi Ene-Obong, ex-54gene.)

Why They Matter: Comeback founder with domain expertise after 54gene closure. Capital-intensive infrastructure play

The Story: After 54gene shut down in 2023 despite raising $45M, Ene-Obong is back with lessons learned

Watch For: Research partnerships and Series A

PART VI: LOGISTICS & SUPPLY CHAIN

Moving goods across fragmented markets

38. Apexloads (Kenya, Founded: 2023)

The Pitch: Freight SaaS for Africa

What They Do: Apexloads is a Software-as-a-service solution for freight stakeholders, streamlining cargo transport with vetted logistics partners

Why They Matter: Google for Startups Accelerator Africa Class 9. Africa’s fragmented logistics sector needs software layer

Watch For: Shipper adoption

39. Yemaachi Biotechnology (Ghana, Founded: 2019, Major Traction: 2023-2024)

The Pitch: Lowering cancer’s economic burden

What They Do: Yemaachi Biotechnology is a biotech startup in Ghana working to make cancer treatment more accessible and affordable

Why They Matter: Africa has lowest cancer survival rates globally due to cost and access. Yemaachi is tackling root causes

Watch For: Clinical trial results and partnerships

40. Weego (Morocco, Founded: 2020, Major Round: 2024-2025)

The Pitch: Citymapper for Africa

What They Do: Weego creates real-time urban transportation data and ticketing for public transit

Why They Matter: 400M Africans use public transport daily, 81% struggle to plan trips. Backed by Morocco’s CDG Invest and SOSV. Targeting $5M raise in 2026 for Morocco, Senegal, Ivory Coast expansion

Watch For: City partnerships and user adoption

PART VII: B2B SaaS & INFRASTRUCTURE

The boring software that scales businesses

41. Regulon (Ghana, Founded: 2023)

The Pitch: AI-powered compliance

What They Do: Regulon simplifies regulatory compliance and business onboarding across Africa and EMEA using AI

Why They Matter: Google for Startups Accelerator Africa Class 9. Cross-border African businesses drown in compliance complexity

Watch For: Enterprise client wins

42. Midddleman (Nigeria, Founded: 2023)

The Pitch: Intelligent sourcing from China

What They Do: Midddleman is a payment platform helping African businesses import and pay for goods from China faster, safer, and cheaper

Why They Matter: Google for Startups Accelerator Africa Class 9. China-Africa trade is $200B+/year but payment rails are broken

Watch For: Transaction volume

43. PayTic (Cameroon, Founded: 2019, Major Product Launch: 2024)

The Pitch: Card program management

What They Do: PayTic is a back-office automation for payment issuers—customer support, chargebacks, fraud, AML, reporting. Works regardless of processors or networks involved

Why They Matter: Unique infrastructure play. Every African card issuer needs this

Watch For: Issuer partnerships across Francophone Africa

44. Vinlogs (Kenya, Founded: 2025)

The Pitch: Blockchain vehicle history

What They Do: Vinlogs is a vehicle history reports using blockchain, AI fraud detection, and multi-country data integration

Why They Matter: Combating odometer fraud ($3,300-$4,000 loss per vehicle), 100+ committed users pre-launch. In discussions with regulators in Uganda, South Africa, Ghana, Ethiopia, Tanzania

Watch For: MVP launch and regulatory approvals

45. PipeOps (Nigeria, Founded: 2021, Seed Round: 2025-2026)

The Pitch: AI-powered cloud automation

What They Do: PipeOps automates complex cloud workflows so businesses and developers can transition to cloud without in-house cloud expertise

Why They Matter: Pre-seed backed by angels, preparing seed round for end of 2025/early 2026. DevOps is critical infrastructure

Watch For: Seed round announcement

46. Zerone Analytiqs (Ghana, Founded: 2024)

The Pitch: Solving Africa’s data scarcity

What They Do: Zerone Analytiqs is a two-pronged solution revolutionizing how data is sourced, analyzed, and utilized for decisions

Why They Matter: Google for Startups Accelerator Africa Class 9. Data infrastructure is Africa’s silent crisis

Watch For: Early customer traction

PART VIII: E-COMMERCE & RETAIL

Digitizing Africa’s $2 trillion informal retail

47. Cedisaver (Ghana, Founded: 2023)

The Pitch: Fashion e-commerce aggregator

What They Do: Cedisaver is a single platform aggregating informal fashion vendors, data-driven trend forecasting

Why They Matter: GHS64,115 revenue, 500+ products sold, 218+ customers in first year. Ghana fashion market projected $1.3B by 2030

Watch For: Vendor network growth and GMV

48. Justyol (Egypt/Turkey, Founded: 2022)

The Pitch: Turkish fashion to MENA

What They Do: Justyol is connecting Turkish fashion brands to Middle East and North Africa markets

Why They Matter: Raised funding to expand in Morocco, preparing for Series A

Watch For: Morocco launch and Series A

49. FARO (South Africa, Founded: 2023)

The Pitch: Re-commerce for Africa

What They Do: FARO is a platform for buying/selling pre-owned goods

Why They Matter: Founded by William McCarren (ex-Zumi), $6M raise in 2024 led by Bloomberg President

The Story: Comeback founder after Zumi shutdown. Secondhand economy is massive opportunity

Watch For: Category expansion beyond fashion

PART IX: CREATOR ECONOMY & EDTECH

Monetizing talent

50. Storipod (Nigeria, Founded: 2023)

The Pitch: Substack for Africa with crypto rails

What They Do: Storipod is a creator monetization platform in partnership with Busha for instant stablecoin payouts

Why They Matter: Solving payment rails problem for African creators. Traditional platforms take 30 days+ for African payouts

Watch For: Creator onboarding numbers and revenue metrics

THE BIG PICTURE: WHAT’S REALLY DIFFERENT ABOUT THIS WAVE

1. Infrastructure Over Apps

Look at the list. It’s not dominated by “Uber for X” or “Airbnb for Y.” These companies are building:

- Large language models (Awarri, CompasAI, Intella)

- Semiconductor chips (Infinilink)

- Battery-swap networks (Spiro)

- Cold storage infrastructure (Keep It Cool)

- Payment rails (HUB2, PayTic, Midddleman)

- Compliance systems (Regulon, E-doc Online)

The 2022-2025 cohort learned: apps without infrastructure don’t scale in Africa. You have to build the rails first.

2. Climate Tech Isn’t Hype—It’s Economics

Of our 50 companies, 18 are climate tech (36%). This isn’t virtue signaling. It’s because:

A. Energy poverty is solvable with current technology

B. Pay-as-you-go models generate cash from day one

C. DFIs and climate funds provide patient, massive capital ($1.04B in 2023, $1.5B+ in 2024)

Climate tech captured 53% of total African startup funding in 2025. This isn’t a bubble—it’s infrastructure building dressed up as climate action.

3. AI Is Finally African

Every previous African “AI” startup was just an API wrapper around OpenAI. Not anymore.

Awarri is training models on Nigerian languages. CompasAI built psychometric AI for African career paths. Infinilink is building actual chips. Intella owns Arabic dialect speech recognition.

For the first time, African AI isn’t downstream of Western AI—it’s solving problems Western AI can’t.

4. Google Is The New Y Combinator

Notice the pattern? Of our 50 companies:

- 15 are Google for Startups Accelerator Africa alumni (Class 9, selected from 1,500 applications)

- 6 are Catalyst Fund portfolio companies

After Y Combinator’s retreat from Africa in 2023, Google stepped in. Their equity-free accelerator provides:

- Up to $350,000 in Google Cloud credits

- Mentorship from Google engineers

- Access to global investor networks

For early-stage African startups in 2024-2025, Google’s accelerator matters more than traditional VC.

5. Francophone Africa Is No Longer The Afterthought

Of our 50 companies:

- Tunisia: 4 companies (Flouci, Konnect, Alder, Expensya)

- Senegal: 2 companies (TOLBI, Yobante)

- Morocco: 2 companies (Weego, ORA)

- Egypt: 7 companies (Khazna, Bokra, Klivvr, Infinilink, Intella, NoorNation, Justyol)

- Cameroon: 1 company (PayTic)

- Rwanda: 3 companies (AFRIKABAL, Smartel Agri Tech, Spiro operations)

For decades, Anglophone markets (Nigeria, Kenya, South Africa) dominated. But regulatory harmonization in Francophone zones (WAEMU, CEMAC) plus untapped markets are attracting founders and capital.

6. The Comeback Founders Are The Best Bet

Notice the pattern:

- Abasi Ene-Obong (Syndicate Bio after 54gene’s $45M implosion)

- William McCarren (FARO after Zumi shutdown)

- Silas Adekunle (Awarri after selling MekaMon to Apple then pivoting)

VCs used to avoid founders with failed startups. Now they seek them out. Failure in Africa isn’t disqualifying—it’s expensive tuition. The founders who come back know where the landmines are buried.

7. Regulation Is The Moat

The winners aren’t just building technology—they’re building regulatory relationships:

- Awarri partnered with Nigeria’s NITDA and NCAIR

- Khazna applying for Egyptian banking license

- Klivvr acquired Egyptian consumer finance license

- Flouci fully licensed in Tunisia, expanding to three countries

- Vinlogs in discussions with regulators across five countries

In African tech, regulatory capture is competitive advantage.

8. The Exit Myth

Here’s the uncomfortable truth: almost no company on this list will exit to Google, Visa, or Stripe for $1 billion.

But that’s not the point.

The real action is African companies acquiring each other. Regional champions consolidating. Nigeria’s winners entering Kenya. Kenya’s winners entering Nigeria. Francophone leaders acquiring Anglophone plays.

The next decade won’t be defined by Silicon Valley exits. It’ll be defined by Pan-African consolidation into $5-10 billion market cap companies that Americans have never heard of.

WHAT TO WATCH IN 2026

Q1: Licensing Decisions

- Khazna’s Egyptian banking license (mid-2026)

- Flouci’s Moroccan, Algerian, Benin launches

- Vinlogs’ regulatory approvals across East/West/Southern Africa

Q2: The AI Wars

- Awarri’s N-ATLAS developer adoption numbers

- CompasAI’s revenue metrics and regional expansion

- Intella’s Arabic dialect expansion

Q3: Climate Tech Consolidation

- Who acquires whom in the solar space?

- Battery-swap network wars (Spiro vs. new entrants)

- Keep It Cool regional expansion post-Earthshot Prize

Q4: Funding Environment

- Will average deal sizes keep climbing?

- Can fintech reclaim dominance from climate tech?

- Which sectors emerge as 2027’s “hot” category?

THE CONTRARIAN TAKE: WHY THESE 50 MATTER MORE THAN THE UNICORNS

Everyone talks about Flutterwave’s $3B valuation. Or Andela’s $1.5B valuation. Or Interswitch’s rumored billions.

But those companies are fighting yesterday’s battles. They raised massive rounds at peak-2021 valuations. They’re managing down-rounds, layoffs, and profitability pressures.

The 50 companies on this list are fighting tomorrow’s battles. They raised in the downturn. They never got drunk on easy capital. They’re building for durability, not vanity metrics.

Flutterwave processes payments. Awarri is building AI that preserves African languages.

Andela connects talent. CompasAI ensures that talent stays employable as AI automates