Zeal, the Egyptian customer loyalty fintech, has secured a significant $4 million in funding in a successful round led by Raed Ventures and Cur8 Capital, with support from angel investors. The startup plans to use this capital to expand its cutting-edge technology solutions across the EMEA region, following its recent entry into the UK market.

Central to Zeal’s offerings is the SmartPOS Plugin, a revolutionary tool for in-store customer engagement and payment intelligence. This technology enables credit card machines to identify, segment, and retarget in-store customers, fundamentally transforming how physical retailers connect with and retain their clientele.

Building on partnerships with Ingenico and Network International, and recognized by the Visa Everywhere Initiative, Zeal’s $4 million funding fuels global expansion. They’ll bolster their portfolio of payment acquirers, simplifying POS integration for thousands of terminals, particularly in [target region/number of terminals]. This cements Zeal’s position as a leader in in-store customer engagement and loyalty.

We’ll connect countless shoppers with countless retailers.

Omar Ebeid, Zeal’s CEO

Omar Ebeid, Zeal’s CEO, is buzzing about the future: ‘This investment fuels our global mission to revolutionize retail through AI-powered customer experiences. We’ll connect countless shoppers with countless retailers.’

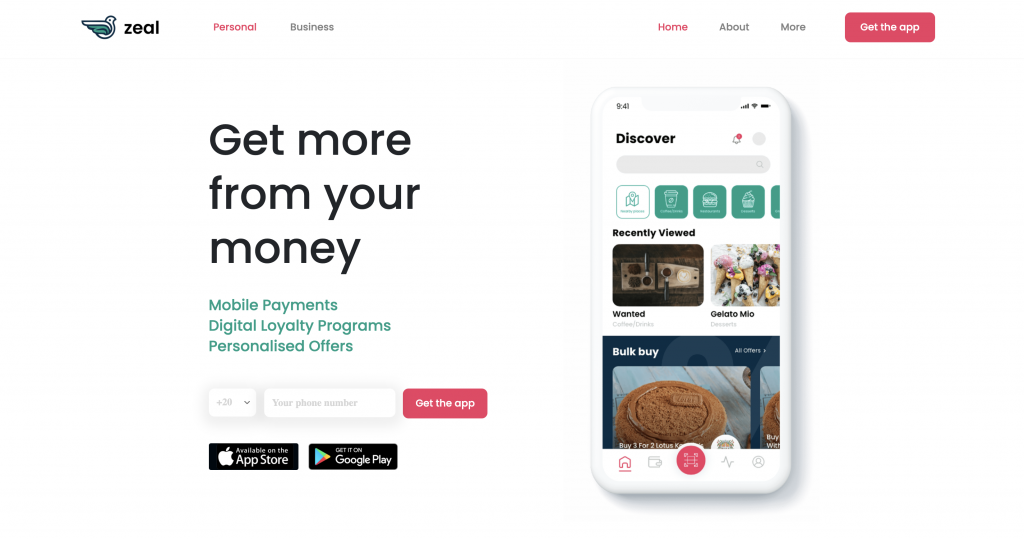

Founded in 2019 by Omar Ebeid, Bellal Mohamed, and Amr Mohamed, Zeal offers users the ability to link their payment method to the app’s QR code, streamlining the payment and loyalty punch collection in a single transaction at in-store locations.

Vendors gain access to a data analytics dashboard, providing real-time spending insights at their branches. Utilizing artificial intelligence, the dashboard allows vendors to predict future customer spending. It offers actionable insights to influence consumer behavior, engage customers through targeted offers and notifications, and analyze customer data to enhance purchasing frequency and foster customer loyalty.