Partech, a leading global investment firm, has successfully completed the final closing of its second Africa-focused fund, Partech Africa II, reaching a hard cap of €280 million (over $300 million). In addition to this significant financial milestone, Partech has further committed to the African technology sector by opening a new office in Lagos, Nigeria.

This latest fund has not only garnered renewed commitments from major investors of its preceding fund but has also attracted new backers eager to support the Partech Africa platform and the broader African venture capital landscape.

The final closing, which was oversubscribed, marks a new era of global institutional support for the fund. It has expanded its investor base to include US and Middle Eastern pension funds and sovereign wealth funds.

This diverse group of investors now features contributions from Africa Re and the Dubai Future District Fund (DFDF), joining early backers like Orange, AXIAN Investment, and the African Development Bank Group (AFDB), thereby reinforcing the fund’s robust and varied support system.

The success of Partech Africa II is underscored by the support from over 40 international investors, including commercial entities such as South Suez and Bertelsmann, family offices, and esteemed Development Finance Institutions (DFIs).

Notable DFIs backing the fund include KfW (German Development Bank) as an anchor investor, the European Investment Bank (EIB), the International Finance Corporation (IFC) of the World Bank Group, FMO (the Dutch Entrepreneurial Development Bank), Bpifrance Investissement, British International Investment (BII), DEG – Deutsche Investitions – und Entwicklungsgesellschaft mbH, and Proparco.

This financial accomplishment is parallel to Partech’s strategic initiative to expand its team, enhancing its mission to foster technological innovation and growth across Africa.

We are profoundly thankful for the unwavering support and dedication of our investors: nearly all investors from Fund I have recommitted, with some even more than doubling their initial investment.

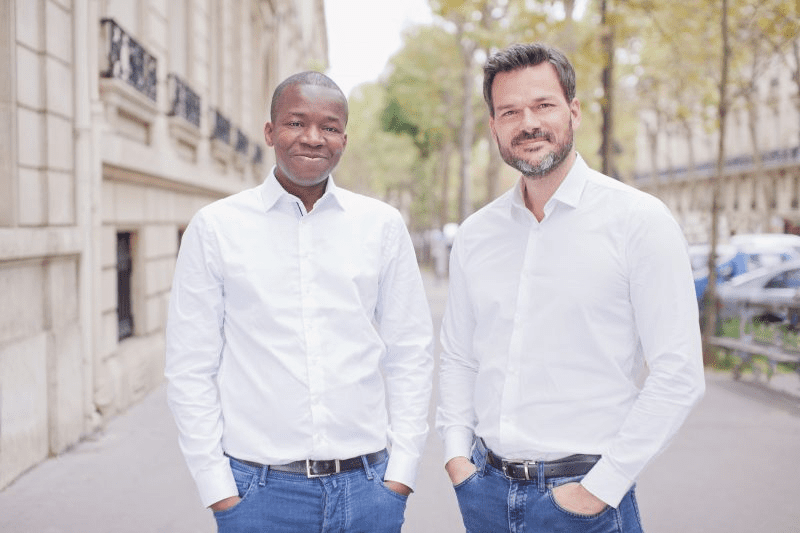

Cyril Collon, a General Partner at Partech

Cyril Collon, a General Partner at Partech, expressed gratitude towards the firm’s investors, highlighting the continued trust and increased commitments, “We are profoundly thankful for the unwavering support and dedication of our investors: nearly all investors from Fund I have recommitted, with some even more than doubling their initial investment.”

In line with its growth strategy, Partech Africa is in the process of hiring a senior executive for “Portfolio Strategy & Operations” to spearhead value creation and exit strategies, as well as a Lagos-based Investment Analyst to strengthen its team.

This announcement of Partech Africa II’s closing comes at a critical time, juxtaposed with a 50% reduction in active investors within the African tech ecosystem, a trend noted in Partech’s 2023 Africa Tech Venture Capital Report.

This positions Partech Africa II not just as a financial triumph but as a pivotal movement toward revitalizing investor engagement and support in the African technology landscape.

Collon emphasized the critical importance of obtaining funding across all stages, from Seed to Early Growth, given the current landscape. This underscores their commitment to fostering the growth of tech enterprises capable of delivering transformative impacts on African economies and contributing to global innovation.

Partech empowers African tech dreams.

Based in Dakar, Senegal, Partech Africa stands out as a leading venture capital fund dedicated to nurturing technology startups throughout Africa. The fund participates in equity rounds from Seed to Series C, focusing on startups that are innovating within technology applications across a diverse range of sectors, including education, mobility, finance, healthcare, logistics, energy, and others.

Partech, a worldwide technology investment firm with its headquarters in Paris, maintains a global presence through its offices in Berlin, Dakar, Lagos, Dubai, Nairobi, and San Francisco. The firm champions independent thinking, steering clear of the limitations set by prevailing trends or rigid methodologies.

Partech’s strategy is deeply rooted in collaboration, focusing on working intimately with the founders they back, jointly striving for success. With a rich 40-year history that began in San Francisco, Partech now oversees €2.5 billion in assets under management (AUM). The firm has a varied portfolio of 220 companies spread across 40 countries on four continents, offering capital, operational expertise, and support from the seed to growth stages.

Comments 1