Sub-Saharan Africa grapples with the world’s highest remittance costs, with the World Bank highlighting an increase in the average cost of sending $200 to the region from 7.2% in the second quarter of 2022 to 7.9% in the same quarter of 2023.

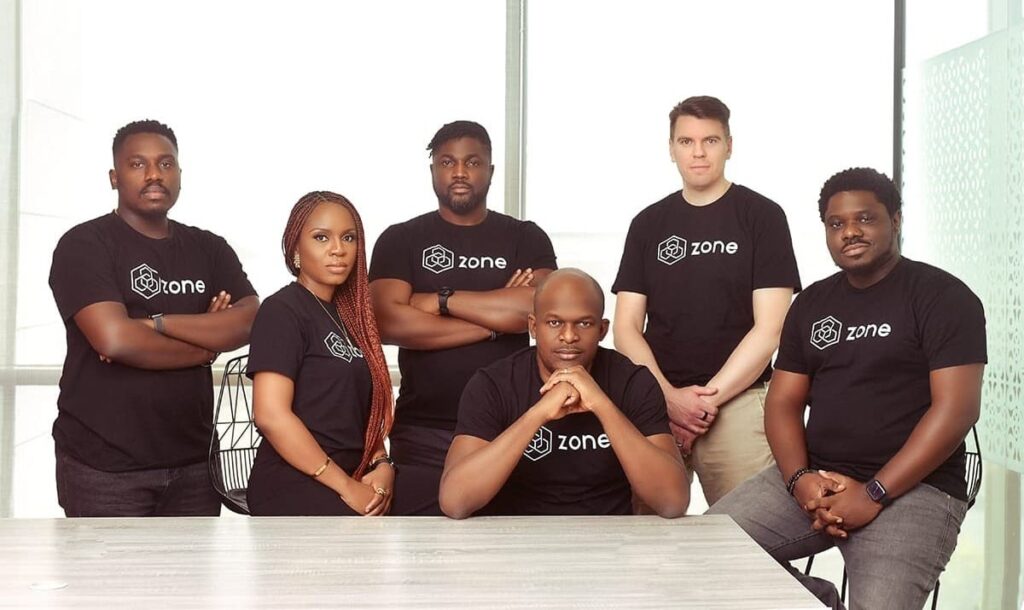

Appzone Group, transitioning from its fintech software roots, unveiled Zone and Qore in a strategic pivot, establishing these as its Banking-as-a-Service ventures, each now operating as independent entities since 2022.

Obi Emetarom, co-founder and CEO of Zone, emphasized the use of blockchain technology through Zone to link all monetary value storage mechanisms, ensuring reliable, seamless, and universally interoperable payments. “Our vision with Zone is to create a singular global network that facilitates payments in any form and currency, thereby driving financial inclusion and spurring economic growth across Africa and globally,” Emetarom stated.

Zone is a regulated blockchain platform aimed at simplifying digital currency transactions and their acceptance. It operates on Africa’s inaugural Layer-1 blockchain network, enabling direct transactions among financial institutions, promising reduced transaction fees, instant dispute resolution, and reliable payments across the continent and abroad.

The platform is witnessing a growing adoption, with over 15 African banks and fintech startups, including Access Bank Plc, Guaranty Trust Bank Plc, and United Bank of Africa, integrating Zone. Following this traction, Zone successfully raised $8.5 million in a seed funding round that saw contributions from Flourish Ventures and TLcom Capital, alongside other notable blockchain venture capital firms.

Emetarom explained, “After spinning off from the parent company, it was natural to secure funding to sustain our growth trajectory.”

The investment aims to bolster Zone’s domestic presence by integrating more banking and financial entities. Furthermore, a significant allocation is earmarked for a pivotal pilot in 2025 to evaluate Zone’s efficacy in facilitating smooth cross-border transactions. Zone aspires to establish itself as a premier global payment network.

Ameya Upadhyay, a partner at Flourish Ventures, lauded Zone’s groundbreaking technology for enabling direct interactions within the payment ecosystem. “Zone’s innovation marks a significant advancement, promising customers a new level of reliability, speed, and cost-efficiency for ATM, POS, and online transactions,” he remarked.

In a notable achievement in 2022, the Central Bank of Nigeria awarded Zone a payment switching and processing license, thereby enhancing its capability to offer extensive transaction switching and processing services to banks and fintechs through its blockchain infrastructure.