In December 2023, TymeBank announced a significant achievement, celebrating its first month of profitability less than five years after its launch in February 2019. Positioned as the inaugural digital bank to break even in South Africa, this milestone underscores TymeBank’s rapid ascent in the global digital banking landscape.

“This achievement marks a pivotal moment for South Africa’s only black-controlled bank, positioning it as one of the fastest-growing digital banks globally and the first African digital bank to reach this milestone,” stated the bank in a media release on Tuesday.

Coenraad Jonker, CEO of TymeBank, expressed pride in the accomplishment, highlighting, “Having achieved our first month of profitable operations in a significantly shorter timeframe is a South African success story that our 8.5 million customers can share with pride.

The success is attributed to TymeBank’s distinctive model, seamlessly integrating digital channels with in-store kiosks at major retailers. This innovative approach has enabled the bank to consistently acquire approximately 150,000 customers monthly.

As reported by Businesstech, TymeBank Chairperson Thabani Jali expressed gratitude to investors for their continued faith, stating, “To acknowledge their investment, we are committed to building a sustainable future that delivers a solid return on investment.”

Dr. Patrice Motsepe, founder and chairman of ARC, highlighted over four years of dedicated effort and investments, stating, “TymeBank’s unique proposition continues to digitally disrupt and transform the banking sector.”

CEO Jonker sees this achievement as aligning with the bank’s goal of becoming one of the top three retail banks in the country. In his words, “We are confident that our proven track record of success positions us well to achieve this audacious aim in the next few years.

How it all started

The acronym TYME traces its roots back to June 2012 when a team within Deloitte Consulting, led by Coen Jonker, Tjaart van der Walt, and Rolf Eichweberas, spun out as a mobile money remittance operator. With funding from MTN, TYME aimed to empower retailers with technology, enabling them to offer local remittance services at a more affordable rate than traditional banks.

In November 2012, TYME achieved a significant milestone by partnering with the South African Bank of Athens (now GroBank) and securing Pick n Pay as a customer. The collaboration focused on utilizing mobile money as a conduit for remittance within South Africa, with Pick n Pay and Boxer Superstores playing key roles in the implementation.

TYME’s inception marked a groundbreaking effort in the mobile money and remittance space, laying the foundation for its transformation into a digital banking powerhouse and ultimately achieving profitability in December 2023.

In 2013, TYME initiated an expansion by forming a partnership with Ebank to establish a low-cost digital bank in Namibia. This strategic move aimed to utilize TYME’s expertise in building a core banking system to introduce innovative financial services to Namibian customers, leading to the successful launch of the digital bank in 2014.

However, TYME’s journey took a notable turn in January 2015 when it was acquired by The Commonwealth Bank of Australia (Commbank or CBA) for AU$40 million (~R365 million). This acquisition prompted TYME to divest its 38.3% stake in Ebank to PointBreak, an investment company in Namibia.

Beginning with Commonwealth Bank’s acquisition of TYME for its skilled team and advanced core banking platform, the vision was to leverage existing technology for the establishment of a retail bank. Despite navigating two and a half tumultuous years, characterized by the pursuit of a full banking license from the South African Reserve Bank (SARB), TYME persevered.

Throughout this period, partnerships with Pick n Pay were strengthened, resulting in a money transfer agreement in May 2016 and a substantial 10-year distribution deal in February 2017. TYME showcased innovation by introducing proprietary kiosks.

However, challenges surfaced in February 2017 when MTN terminated its partnership with Tyme, citing a “lack of commercial viability.” Consequently, Tyme ended its association with both MTN and the Bank of Athens. Co-founder Rolf, who led partnerships, resigned, and several developers departed for OUTsurance.

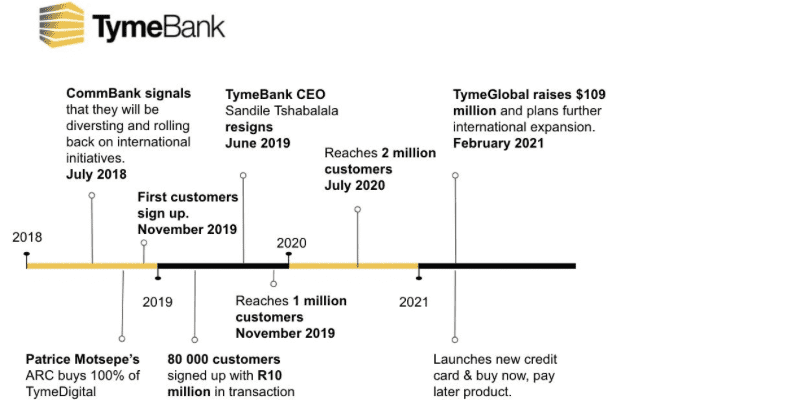

Undergoing a transformative phase, TymeDigital secured investment from South African Billionaire Patrice Motsepe’s African Rainbow Capital (ARC), acquiring a 10% stake. In 2018, as Commonwealth Bank began retreating from international markets to refocus on Australasia, ARC seized the opportunity to purchase Commbank’s 90% stake. The transaction concluded in September 2018, leading to the rebranding of TymeDigital to TymeBank, with its inaugural customers signing up in November of the same year.