The “funding winter” affecting African tech startups continues to persist, with first-quarter funding in 2024 plunging over 50% to US$310 million from US$650 million in the same period last year.

The African Tech Startups Funding Report’s ninth edition, released in January by Disrupt Africa in collaboration with Flourish Ventures, AAIC Investment, and Atlantica Ventures, reveals that throughout 2023, a total of 406 startups secured US$2.4 billion in funding. This represents a reset for the African tech scene amidst a global capital crunch, with a 35.9% decrease in the number of funded startups from 633 in 2022, and a 27.8% drop in total funding from US$3.33 billion in the previous year.

The dim outlook for 2024 is underscored by a disappointing Q1, where funding plummeted to US$310 million, marking a 52.3% decline compared to the US$650 million raised in the corresponding quarter of 2023. This decline is nearly consistent with the 57.2% decrease observed in Q1 2023 compared to Q1 2022.

In the first quarter of 2024, the number of funded ventures slightly decreased to 82 from 87 in Q1 2023, compared to 175 startups funded in Q1 2022, indicating a slowdown in the rate of decline. However, if funding levels continue at this pace, 2024 is on track to surpass 2023 in terms of reduced funding for African tech ventures.

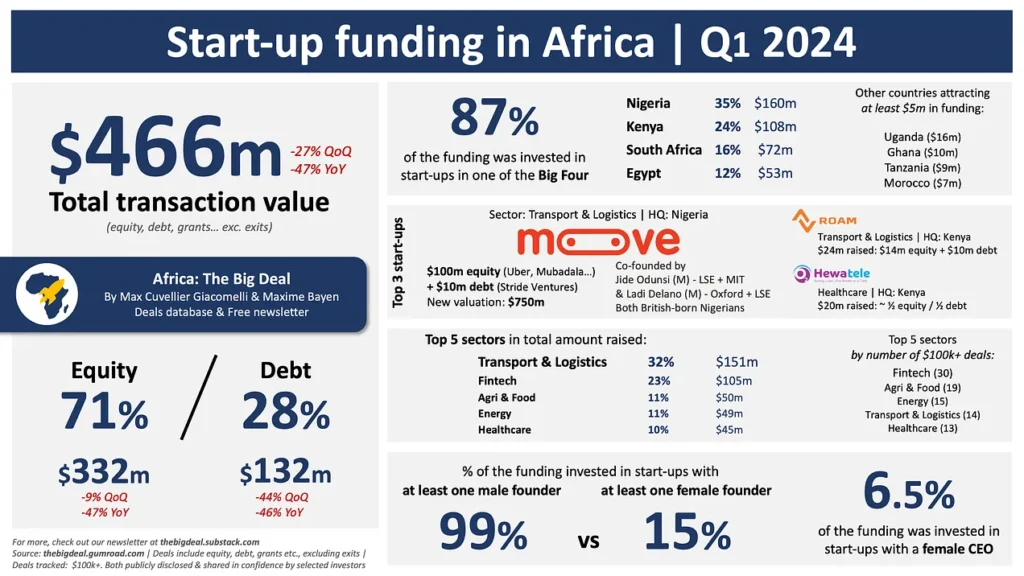

The comprehensive data collected by The Big Deal, an African tech funding tracker, meticulously outlined every funding round that took place in the first quarter of the year, providing an in-depth analysis in its latest report. This report serves as a vital resource for understanding the financial landscape of the tech industry across the African continent, offering detailed insights into the amounts raised, the stages of the deals, and the sectors that attracted the most interest from investors. By aggregating this information, The Big Deal not only highlights the trends and patterns of investment in African tech startups but also sheds light on emerging opportunities and challenges within the ecosystem.