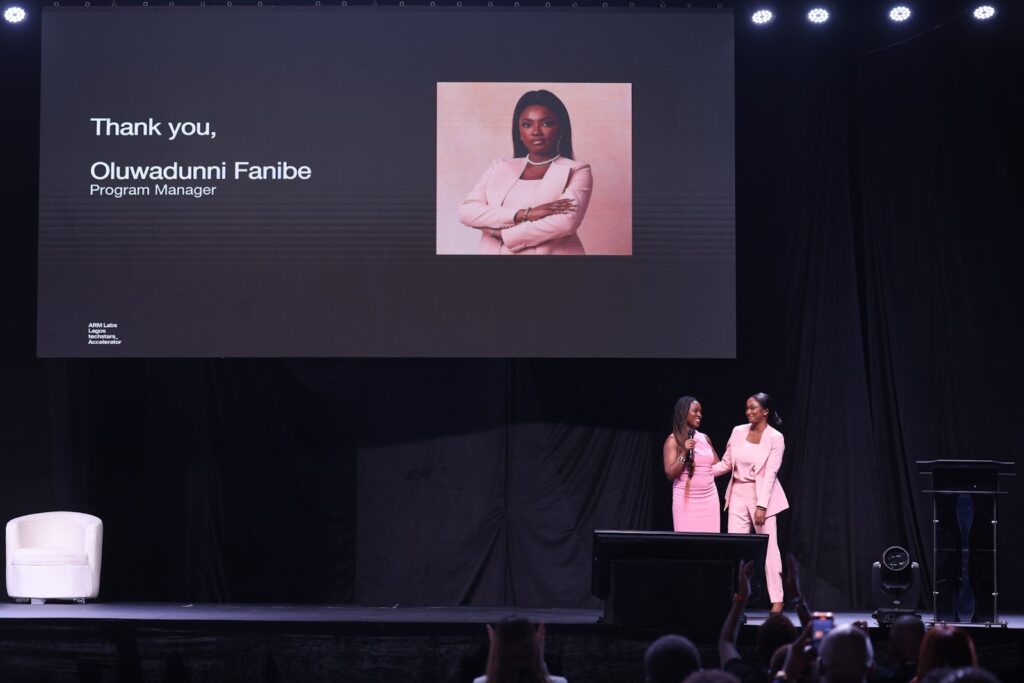

Oluwadunni is a Program Manager at Techstars, the most active early-stage investor in Africa. Her work cuts across investment and operations, with a focus on deal sourcing, screening, and venture building. Prior to joining Techstars, she worked at the FinTech-focused VC fund, Greenhouse Capital.

She holds a degree in Economics from Obafemi Awolowo University and worked in various roles across different startups before transitioning into VC. Her previous experience as an operator, deep understanding of the African market, as well as her analytical and creative problem-solving skills, provided her with the foundational knowledge required to navigate the dynamic African VC ecosystem.

In this exclusive conversation, Oluwadunni narrates her inspiring journey in the African tech ecosystem, detailing the challenges and triumphs she has encountered along the way. She also shares invaluable insights into the current state of venture capital funding in Africa, drawing from her extensive experience and unique perspective from working closely with startups.

Additionally, she discusses the evolving landscape of tech investments, the opportunities for startups, and the strategies that have proven successful in securing funding in this dynamic market.

So can you tell us about your background?

I graduated from Obafemi Awolowo University with a degree in Economics. While in university, I worked two jobs—one with an entertainment website and another with a fashion magazine. Given my experience in fashion writing and entertainment, transitioning into public relations after graduation felt natural. My first real job out of school was with a PR firm. Prior to this role, I had completed multiple internships and worked as a sales executive.

Working in PR led me to the startup world, where I held various roles in marketing, customer service, hiring, sales, and operations, immersing myself in the entrepreneurial ecosystem. It was during this time that I stumbled into venture capital (VC).

Along the way, I came across an early-stage, female-focused VC fund and joined the team. My ultimate North Star has always been to support women and contribute to bridging the gender equality gap in some way. Therefore, it made sense to work with an organization focused on providing female founders with greater access to capital. I worked there briefly, but that experience sparked my curiosity and paved the way for further exploration in the VC space.

Subsequently, I joined Greenhouse Capital, a leading FinTech investor in Africa, as a Program Manager. There, I managed two programs: one in partnership with Microsoft for East and West Africa, and another for female founders in Francophone Africa.

My journey eventually led me to Techstars, where I currently serve as a Program Manager. I also love languages. A few years ago, I moved to Benin Republic for eight months, where I attended a language school while preparing for the DELF B1 and B2 French exams. Additionally, I recently completed Oxford’s Private Equity and Venture Capital programme. Continuous learning is a value I hold dearly, so I intend to further my education in the near future and hopefully learn Mandarin someday.

What do you enjoy about working in Venture Capital?

I love working in VC for several reasons but there are 3 core reasons. The first is that I enjoy building from the ground up, and working with early-stage startups allows me to do that. The positive impact our investments have on founders’ lives also brings me immense satisfaction. Finally, working in VC provides endless opportunities for learning and growth by exposing me to diverse industries, technologies, and markets.

What sparked your interest in Techstars?

Before joining Techstars, I was well aware of their global reputation, and with the launch of their new program in Lagos in 2022, they were clearly doubling down on Africa, and I wanted to be a part of that.

What primarily attracted me to Techstars was their founder-first approach to investing, this philosophy resonates with my belief that the success of any early-stage startup is fundamentally rooted in the strength and vision of its founders.

I also wanted to join a fund that was not only writing checks but also providing support through mentoring, coaching, and other resources necessary to help entrepreneurs flourish.

Finally, Techstars’ global reach was a compelling factor for me; I saw it as an opportunity to collaborate with founders across various markets, expand my network, and increase my exposure. Thereby allowing me to gain insights into more ecosystems, enrich my knowledge base and in turn enhance my ability to support startups more effectively.

Can you provide an overview of the current state of the VC landscape in Africa and how you see it evolving in the coming years?

We’re currently navigating what I prefer to view as a correction phase within the ecosystem. Some may refer to it as a winter or a downturn, but from my perspective, it’s a necessary recalibration. Over the last 2 years, we’ve observed a significant shift in funding dynamics globally and in turn in Africa.

In 2021 & 2022, following the pandemic’s onset, there was a surge of excitement in investment activity. However, due diligence processes were often sidelined as investors rushed to capitalize on opportunities. It was a “favorable” climate for founders, where fundraising rounds could swiftly close within weeks.

Fast forward to the present, and we find ourselves in an investor’s market. Investors now have the luxury of conducting more thorough due diligence and evaluating deals with greater scrutiny. While this may result in longer fundraising cycles for founders, it ultimately fosters a more robust and sustainable investment landscape.

Looking ahead, I anticipate that fundraising amongst startups will begin to pick up again. This year, we’ve seen the likes of TLCom, Breega, Partech, 4Dx ventures and a number of other African-focused funds successfully raise substantial capital. This capital will trickle down to startups and is a positive indicator for the market. Furthermore, I expect an increase in mergers and acquisitions among startups, as startups look to support one another and consolidate market share. As well as more startups exploring alternative sources of capital.

What are some of the most pressing challenges facing African startups today, and how can they overcome these challenges?

African founders are honestly some of the most resilient entrepreneurs in the world. Building a business in Africa requires navigating numerous hurdles, and I have immense respect for anyone who chooses the path of entrepreneurship in Africa.

Among the most pressing issues are regulatory uncertainty and an absence of sufficient government support. The nascent nature of the ecosystem means that regulatory frameworks are still evolving, often lagging behind the rapid pace of innovation. To address this challenge, many founders have taken it upon themselves to continuously and proactively engage with policymakers to advocate for clearer regulations on various issues. Additionally, it would be beneficial for the government to provide tax breaks or incentives for startups in the early days at the very least.

The economic landscape also poses challenges for African founders, often marked by high interest rates, escalating inflation, and volatile exchange rates, particularly in countries like Nigeria. These economic factors can exert significant pressure on startup finances, affecting everything from operational expenses to fundraising efforts. To manage this, founders need to prioritize building revenue-generating businesses rather than relying solely on fundraising for sustainability. When external funding is necessary for scaling, they should consider alternative sources of capital, such as debt funding in local currency. Additionally, seeking revenue from international markets can help mitigate local economic risks, though I understand that this can be particularly challenging for certain sectors.

Finally, talent acquisition and retention, especially for senior roles, present another hurdle. The pursuit of better opportunities often drives top talent to seek careers abroad, resulting in talent shortages for startups. This challenge is trickier to manage for senior positions, as experienced professionals are much harder to replace.

Despite these challenges, opportunities abound on the continent. It is projected that by 2050, a quarter of the world’s population will be African, further emphasizing the continent’s potential. Africa boasts a vast untapped market and a young, tech-savvy population, creating fertile ground for immense economic growth and for startups to thrive. Notable successes in the ecosystem, such as Paystack, Interswitch, Fawry, Jetstream Africa, and PiggyVest, exemplify what can be achieved with the right support within 6-10 years.

What sector or industry do you see as the most promising for investment in Africa right now?

The landscape of opportunity in Africa’s startup ecosystem is vast and evolving. Despite advancements in FinTech and financial services, there remains substantial untapped potential for innovation and growth in that sector. With more than half of the population still lacking access to financial services, cash dominating 90% of transactions and 3 out of 10 payments still failing, the potential for innovation in financial technology is immense.

The HealthTech sector is also poised for substantial growth. Healthcare in Africa is very fragmented and with 1.5 billion people in Africa still lacking access to urgent care, there is a clear opportunity for innovation there.

Energy represents another critical area for innovation. With 43% of people in Africa still lacking access to electricity, there is an urgent need for sustainable energy solutions. Startups can develop renewable energy technologies, addressing both economic and environmental challenges.

Additionally, cybersecurity is emerging as a crucial sector in Africa’s tech landscape. As digital connectivity continues to expand, the need to safeguard sensitive data and protect against cyber threats becomes paramount.

In summary, the combination of digital transformation, demographic shifts, and societal challenges creates fertile ground for innovation across those four sectors in Africa. By harnessing technology and entrepreneurship, we can drive meaningful impact, and contribute to sustainable development and economic growth.

As a program manager at Techstars, what are your day-to-day responsibilities?

My role encompasses deal sourcing and screening, as well as venture building, which involves various facets of program development and management.

In deal sourcing, I actively seek out startups across Africa, focusing on key hubs such as Nigeria, Kenya, and Ghana, and tapping into networks in the UK, leveraging the presence of African immigrants and diaspora communities.

When screening startups, I review nearly a thousand pitch decks annually, assessing team composition, traction, market potential, and scalability, identifying those that align with our investment thesis.

On the venture-building front, I build out our 13-week accelerator program from inception to execution, recruiting a diverse pool of 100+ mentors from various industries across different countries and planning roughly 25 workshops and AMAs with sector experts and late-stage founders.

Furthermore, I manage our hiring process. We run a very lean model but the work can get overwhelming very quickly when we are in-program. So during our 13-week program, we bring on 2-3 additional associates for the period to assist with social media, financial models for the founders, and general operations. I manage the hiring and onboarding process and I am directly responsible for them over the duration of their employment.

Additionally, I oversee public relations for specific aspects of the program, drafting press releases and managing communication strategies to promote applications and showcase outcomes.

I also plan and execute our demo days, where our founders pitch their startups to a curated audience of ecosystem leaders, investors, mentors, press, and alumni. Our last demo day event had 450+ attendees in person and another 1500+ attendees streamed virtually on YouTube and LinkedIn. Planning an event of that capacity without an event planner is a logistical hurdle and honestly a daunting task.

What criteria do you focus on when sourcing startups?

When evaluating startups, I prioritize four key factors: team, traction, market, and idea.

First, I assess the team, looking for founder-market fit, the cohesion of the team, and a diversity of skills among co-founders.

Next, I calculate the market size, unit economics, growth potential, and competitive landscape to understand the startup’s positioning.

For the idea, I consider its innovation, defensibility, regulation, and potential risks.

I evaluate traction through metrics like the number of active users, MRR, MoM Growth, CAC, LTV, and fundraising progress.

Additionally, I consider factors like cap table cleanliness and of course, the degree to which the startup is focused on the African market. We only invest in startups building for Africa.

What do you enjoy doing in your free time outside of work?

The nature of my work requires that I work long hours, so when I have free time I really just try to sleep.

I however love to travel- I particularly favor islands. Also, I love having my feet in the ocean, it relaxes me and I also like listening to the waves and enjoy Scuba diving.

Another thing that I enjoy is the Opera. Classical music is very soothing for me, I however only get the full experience when I am out of the country. When I am in Lagos, I make do with video and audio recordings.

I also enjoy adrenaline activities. I have walked with lions, gone skydiving, parasailing, paragliding, ziplining, and of course scuba diving. One of my favorite experiences so far was scuba diving in Mauritius and going 50 feet deep in the Indian Ocean. It was my second time Scuba diving but it was so surreal.

Finally, what resources (books, podcasts, networks, etc.) would you recommend to anyone in tech?

“Vantage” by Olumide Soyombo is definitely one to read. In his book, he shares key insights from his extensive experience in Africa’s startup ecosystem.

“Do More Faster” by David Cohen, Techstars’ CEO & Founder is another essential for founders, providing practical tips for the entrepreneurial journey based on real-world examples.

The Dream VC Fellowship is an option for aspiring venture capitalists in Africa, offering hands-on experience, mentorship, and industry insights.

It’s a pleasure talking to you Oluwadunni.

Thank you for having me, it’s a pleasure as well.